Prepare for stronger C&I lending demand: A $1.7 trillion “wave”

Abrigo

JULY 20, 2024

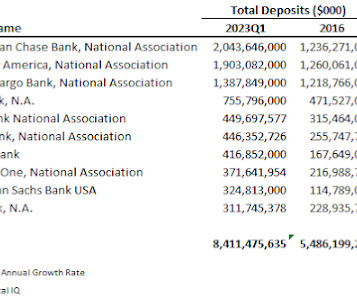

Pruis Examining federal Call Report data from 2016 to Q1 2024 for banks with assets of $70 billion or less, Cornerstone found that only one in 10 institutions that started in 2016 with less than 18% of its portfolio in C&I was able to increase that percentage by 2023. For most of the lenders, C&I lending turned out to be “mush.”

Let's personalize your content