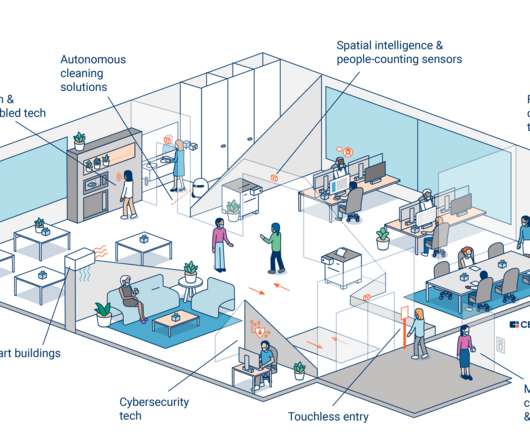

Key Components of a Strong Sanctions Compliance Program

Abrigo

JUNE 14, 2021

Create an effective sanctions program Considering the current economic and political environment, it is crucial that financial institutions maintain a strong sanctions compliance program (SCP). Takeaway 1 OFAC has issued new guidance on the essential components of a strong compliance program. learn more.

Let's personalize your content