B2B Lender Liberis Raises £32M

PYMNTS

JANUARY 22, 2020

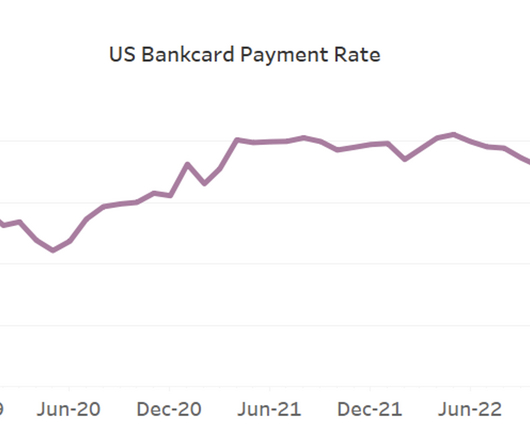

Liberis , a London-based FinTech that lends to small- to medium-sized businesses (SMBs) for future credit and debit card sales, has raised £32 million (more than $42 million), according to City A.M. The FinTech has offices in Denver, London and Stockholm. It also has plans to expand its workforce by 30 percent.

Let's personalize your content