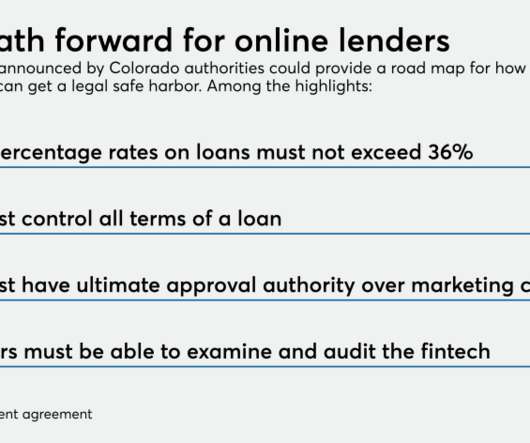

ABA, CBA: Colorado lending caps put state-chartered banks at ‘severe disadvantage’

ABA Community Banking

MAY 14, 2024

ABA and CBA filed an amicus brief in support of a lawsuit brought against Colorado for a new law capping interest rates and fees on loans to state residents made by state-chartered banks, no matter where the bank is located.

Let's personalize your content