Drivers of ROA for Community Banks

South State Correspondent

SEPTEMBER 16, 2024

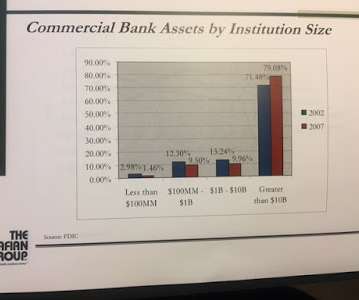

In Q2/24 the average return on assets (ROA) for community banks (under $10B in assets) was 1.08%, with an average ROE of 10.44%. But within the community banking sector, performance varied among banks significantly. The ROA for the community bank sector is shown in the graph below. Another 16.2%

Let's personalize your content