Crafting an effective CECL Q factor framework for stronger risk management

Abrigo

OCTOBER 9, 2024

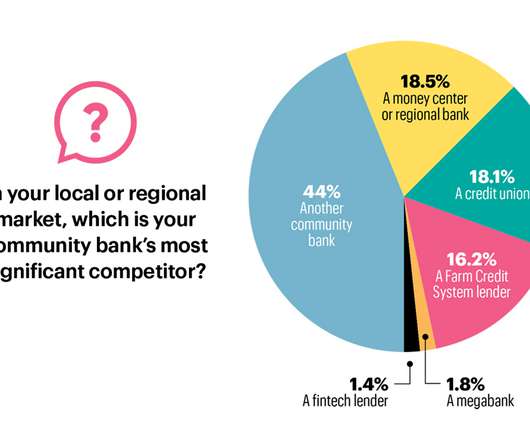

This is where Q factors become essential, offering a way to adjust for future uncertainties, management's insights, and external factors such as regulatory changes or local economic shifts. Properly applied, Q factors allow financial institutions to make their risk assessments more forward-looking and comprehensive.

Let's personalize your content