DoorDash, Airbnb IPOs; BNPL Trends; Pet Fraud Top This Week's News

PYMNTS

DECEMBER 11, 2020

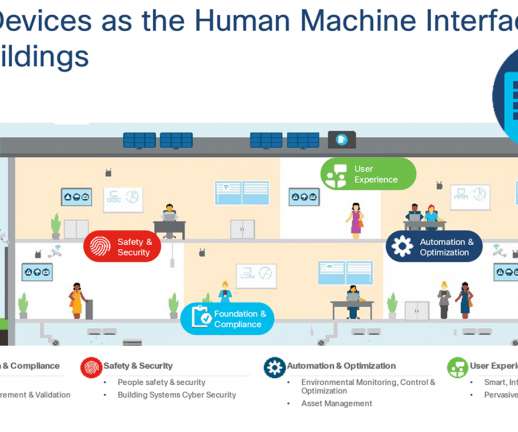

to advance secure, contactless transactions as stores reopen amid COVID-19 restrictions. Peter Hazlehurst, CEO of Synctera, tells Karen Webster that Synctera is a next-gen banking-services platform that facilitates FinTech scale by enabling banks to leverage their current compliance and account-servicing capabilities in new ways.

Let's personalize your content