How Blaze Pizza Fires Up Friendly Fraud Defenses

PYMNTS

SEPTEMBER 21, 2020

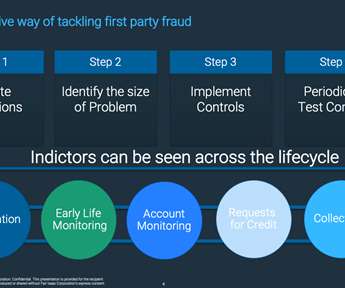

Consumers are using mobile apps’ order-ahead features and loyalty perks more often during the COVID-19 pandemic, yet chargeback fraud — also known as friendly fraud — is unfortunately also rising. Chargebacks were originally instituted as a last resort for customers, but they have gained popularity alongside digital commerce.

Let's personalize your content