A Bank Automation Summit Preview: Key 2023 Banking Automation Trends

Perficient

FEBRUARY 22, 2023

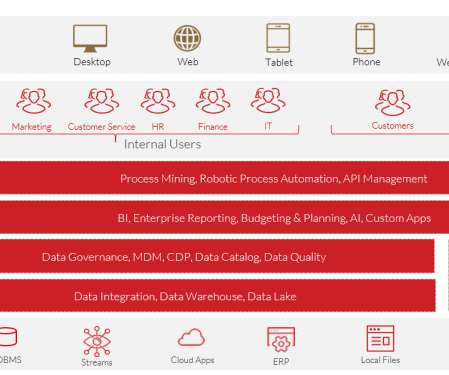

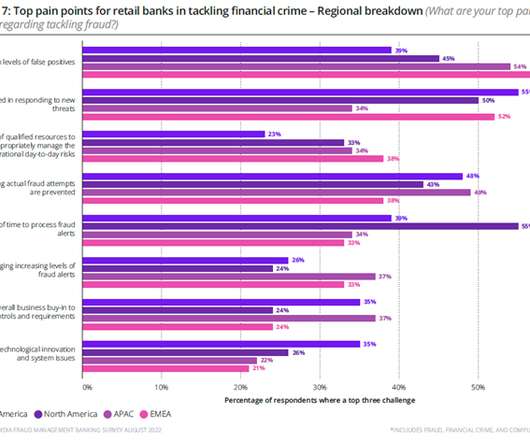

I want to take this opportunity to share the latest hyper-automation trends from my observations in working with clients in the banking industry. AI is increasingly being used to automate a variety of tasks in financial services institutions, including customer service, fraud detection, and loan applications.

Let's personalize your content