How to Better Serve Your Clients with Automated Fulfillment Systems

Perficient

OCTOBER 20, 2020

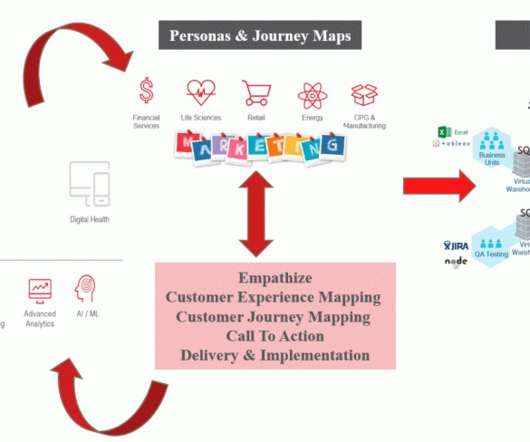

Investing in advanced supply chain automation and intelligent order management (OM) systems will not only improve how your organization fulfills against extreme demand but also serves your consumers more effectively in the end. As a result, the customer experience improved and our client saw record sales numbers during the COVID-19 pandemic.

Let's personalize your content