From cybersecurity to failed mergers, 5 challenges facing banks and credit unions

American Banker

MARCH 11, 2024

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

American Banker

MARCH 11, 2024

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

The Financial Brand

MARCH 12, 2024

This article Winning the War for Deposits: Strategies to Drive Real Growth appeared first on The Financial Brand. Q&A: Kasasa's Ryan Walker on using rewards checking to attract low-cost core deposits and boost engagement without relying on rate shoppers. This article Winning the War for Deposits: Strategies to Drive Real Growth appeared first on The Financial Brand.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

MARCH 14, 2024

Strengthening customer relationships with tangible value and personal touch Customer retention in banking can be challenging for community financial institutions. Follow this guide for strategies to stay competitive. You might also like this SMB Lending Insights report for banks and credit unions Download report Takeaway 1 Banks need to implement customer retention strategies to keep their valuable customers, not just attract new ones.

ATM Marketplace

MARCH 12, 2024

First Internet Bank CEO David Becker believes that banks should take a "forward looking approach" with AI, especially in the area of data processing.

Advertisement

Join us in this webinar, where we share best practices on how to think about the reconciliation work each month, when best to do reconciliations, how they should be prepared, and some common pitfalls to avoid. Learning Objectives: This course objective is to understand how to properly prepare and review balance sheet reconciliations and its impact on the financial statements.

Payments Dive

MARCH 14, 2024

Consumer Reports Senior Director Delicia Hand said preventing fraud and scams is "crucial" for traditional and digital banks alike, as more of their customers use their mobile apps.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Financial Brand

MARCH 11, 2024

This article Why Credit Unions Are Primed to Revolutionize Financial Services in the U.S. appeared first on The Financial Brand. Younger consumers are ready to become credit union customers, if the industry leans into its strengths, powered by digital technology. This article Why Credit Unions Are Primed to Revolutionize Financial Services in the U.S. appeared first on The Financial Brand.

South State Correspondent

MARCH 12, 2024

In a previous article ( HERE ), we discussed several factors that drive loan and bank profitability. We covered in detail how and why community banks can increase loan size to improve return on assets (ROA) /return on equity (ROE). In this article, we will consider how and why loan term is a significant driver of profitability for community banks and what community banks can do to improve performance.

South State Correspondent

MARCH 14, 2024

When it comes to bank planning, your strategic horizon has a huge influence on your success. Recently, we published a piece urging banks to set their strategic planning horizon out longer ( HERE ). We were inundated with questions and opinions. Our overarching point was that banks underperform, in part, because their strategic planning time horizon is too short.

Abrigo

MARCH 13, 2024

How to respond to CRE loan distress Use these tips for banks and credit unions to identify and handle commercial real estate loans that are showing signs of being problem CRE credits. Would you like other articles like this in your inbox? Takeaway 1 Engaging the bank or credit union loan workout team or an outside expert can help restore CRE loans in distress or mitigate their impact.

Advertisement

Treasury teams at community banks face an ongoing challenge of delivering frictionless customer experiences as they support treasury products – especially RDC. This infographic focuses on the efficiencies community banks gain when partnering with a proven managed services provider. You’ll see the advantages you can gain when a managed services partner leverages online tools, skilled customer and technical support personnel, and fulfillment and logistics capabilities to streamline RDC fulfillment

Payments Dive

MARCH 11, 2024

“We are all in an arms race to protect this ecosystem, to protect the network,” Visa CEO Ryan McInerney said at an investor conference last week.

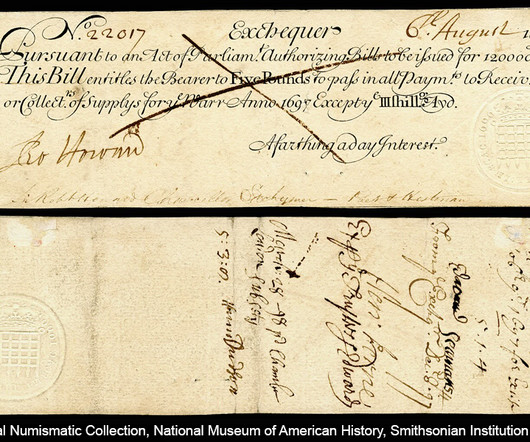

BankUnderground

MARCH 12, 2024

David Rule and Iain de Weymarn Technologies such as distributed ledgers create the possibility of new forms of digital money, whether privately-issued ‘stable coins’, tokenised commercial bank deposits, or central bank digital currencies. Authorities are considering a world where digital money circulates alongside existing forms of money. In the past, the nature of money has often changed.

TheGuardian

MARCH 9, 2024

The PM’s admiration for Washington’s economic model may backfire amid looming US banking and stock market disasters One of the consistent themes of the Conservative economic narrative is an admiration for the US and its ability to grow quickly. The way it has bounced back from the pandemic and how it has ridden out the impact of Russia’s invasion of Ukraine should serve as a blueprint.

William Mills

MARCH 12, 2024

In a time where information reigns supreme, the strategic use of proprietary data in PR and marketing is not just an advantage — it's essential. As data-driven storytelling has become a cornerstone for success, PR and marketing professionals must learn how to properly gather, analyze and derive this information to help create stronger messages, bring more credibility, and garner greater media attention for clients.

Advertisement

Amid market uncertainty, banks and credit unions are faced with critical decisions about the future of their commercial lending. With fluctuating interest rates and rising competition from non-bank lenders, it's critical to allocate your 2025 budget strategically to optimize lending operations. Our Budget Playbook for Commercial Lenders delivers key strategies to help you navigate these challenges, ensuring your institution is well-positioned for the coming year.

Payments Dive

MARCH 15, 2024

“We know dangers exist when more powerful players weaponize industry standards,” Consumer Financial Protection Bureau Director Rohit Chopra said in advance of finalizing an open banking rule later this year.

CFPB Monitor

MARCH 15, 2024

The Consumer Financial Protection Bureau (“CFPB”) filed an opposition brief (the “Opposition”) on Tuesday in response to a request by plaintiff trade groups to enjoin the CFPB’s final credit card late fee rule (the “Final Rule”) during the pendency of a lawsuit seeking to invalidate the Final Rule. In the Opposition, the CFPB argues that plaintiffs are unlikely to succeed on the merits, and that the Final Rule is consistent with the CARD Act’s mandate that late fees be “reasonable and proportion

BankBazaar

MARCH 15, 2024

Ever wondered why you splurge on things you don’t need or why your impulse buys or saving strategies are shap ed the way they are? Dive into the world of psychology of money with us to find out more! In the labyrinth of personal finance, our decisions are often guided not just by numbers and logic, but by other factors, like tradition, information available to us and the avenues of risk we are willing to take.

ATM Marketplace

MARCH 12, 2024

First Internet Bank CEO David Becker believes that banks should take a "forward looking approach" with AI, especially in the area of data processing.

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

Payments Dive

MARCH 11, 2024

The bank’s payments unit plans to engage in more pilots this year before rolling out the checkout service broadly next year, said Prashant Sharma, JPMorgan’s executive director of biometrics and identity solutions.

CFPB Monitor

MARCH 14, 2024

On January 17, 2024, the U.S. Supreme Court heard oral argument in two cases in which the question presented is whether the Court should overrule its 1984 decision in Chevron, U.S.A., Inc. v. Nat. Res. Def. Council, Inc. That decision produced what became known as the “ Chevron judicial deference framework”–the two-step analysis that courts typically invoke when reviewing a federal agency’s interpretation of a statute. .

BankBazaar

MARCH 14, 2024

The end of the financial year is the perfect time to review your financial situation and make strategic moves to optimise your money matters. Here are essential finance moves to consider. As a young professional in India, managing your personal finances effectively is crucial for securing your financial future. With the end of the financial year fast approaching, now is the perfect time to review your financial situation and make strategic moves to optimise your money matters.

William Mills

MARCH 14, 2024

We all cherish those networkers with a superpower for connecting people. Now there’s a conference that’s honed in on meeting the need: Fintech Meetup. Here’s our take on the show.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Payments Dive

MARCH 13, 2024

The BNPL provider’s CEO has suggested the company could IPO “quite soon,” but fintech investors expect the market will first want to see a stronger track record of profitability.

CFPB Monitor

MARCH 13, 2024

As previously reported , bills were introduced in the U.S. House of Representatives (H.R. 7297) and U.S. Senate (S. 3502) to amend the Fair Credit Reporting Act (FCRA) to curtail the practice of trigger leads with mortgage loans. Recently, a diverse group sent a letter to the Chairs and Ranking Members of the House Committee on Financial Services and the Senate Committee on Banking, Housing & Urban Affairs expressing support for the bills.

TheGuardian

MARCH 10, 2024

Exclusive: Shadow City minister Tulip Siddiq to reveal plan for target to end financial exclusion of women Labour plans to set targets for funding female-led businesses through the state-owned British Business Bank and to launch a review of the financial exclusion of women, if it wins the next general election. The initiatives, which will be announced on Monday by the shadow City minister Tulip Siddiq, form part of the party’s financial inclusion agenda, following a review by 10 City grandees ea

American Banker

MARCH 15, 2024

As nonbank entities expand their market share in many traditional banking services and are increasingly intertwined in the banking system, regulators' approach to leveling the playing field has been incremental and situational.

Advertisement

Community banks seek ways to leverage their technology infrastructure to drive productivity and growth. However, the sheer volume of technology devices, capital constraints, and lack of skilled resources stand in the way. This Strategy Brief explores how a managed device services partner can help bridge this resource gap. Managed device services partners empower community banks to take charge of mission-critical device management activities with: Logistics and installation services to support se

Let's personalize your content