Fed raises alarm on synthetic identity fraud

Payments Dive

APRIL 3, 2025

The use of generative AI and fraudulently obtained accounts to execute synthetic identity fraud is on the rise, a Federal Reserve official said in a podcast interview.

Payments Dive

APRIL 3, 2025

The use of generative AI and fraudulently obtained accounts to execute synthetic identity fraud is on the rise, a Federal Reserve official said in a podcast interview.

Abrigo

APRIL 8, 2025

This article covers these key topics: The difference between 1D and 2D risk rating models How CECL has impacted the necessity of a dual approach Why the LGD variable is so difficult to pinpoint Does your risk rating framework align with your CECL needs? More banks are rethinking the value of two-dimensional (2D) risk rating models as CECL and real-world challenges with LGD raise questions about their practicality.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

APRIL 2, 2025

“Liberation Day” brought a 10% baseline tax on all imports plus a 15% to 49% tariff rate on a defined set of nations (below). The move shook the markets, threatening to upend much of the architecture of the global economy and fueled broader trade wars. The recent uncertain shifts in trade policies, particularly increased tariffs on imports from China, Canada, and Mexico, have introduced specific uncertainties for community banks.

Abrigo

APRIL 2, 2025

Payment fraud: What is it and why the payment system used matters Payments are evolving, and so are fraud tactics. As digital transactions become faster and more convenient, fraudsters are finding new ways to exploit vulnerabilities across payment channels. Financial institutions must stay ahead by implementing proactive fraud detection strategies to protect their customers and mitigate losses.

Advertiser: Trellis

Finance teams find Trellis to be particularly effective in conducting comprehensive due diligence on both individuals and businesses. With our court data solution, financial experts can access critical litigation insights, making it an invaluable resource for informed decision-making in the financial sector.

Payments Dive

APRIL 2, 2025

Mastercard and PayPal are among the companies viewing the digital assets as potentially useful for business-to-business transactions.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Jeff For Banks

APRIL 7, 2025

Be a goldfish. Or a zebra. In this latest Jeff4Banks.com video blog, I explore strategic bets, a term not embraced by bankers, likely because of the "bets" and the implication that it is gambling. So often we hear bankers object to making what could be franchise transforming "bets" because they are not goldfish. They take a failed bet some time ago in the past and use it as the reason to kill all future bets.

South State Correspondent

APRIL 1, 2025

As of last month, 68% of iPhone users were running iOS 18 or higher and 92% of Android users are running their 5.0 iOS or higher. This means that thanks to recent Apple upgrades in their operating system, most phones are now capable of receiving Rich Communication Services (RCS) messages in addition to traditional SMS. This transformation promises to bring a plethora of benefits and global brands are now gearing up.

TheGuardian

APRIL 1, 2025

Financial Conduct Authority tells supreme court the 44bn bill could spook businesses and threaten UK investment A court of appeal ruling that has left lenders fearing PPI-level compensation bills over the motor finance commission scandal goes too far, the City regulator said on Monday. The Financial Conduct Authority (FCA) made the comments in a written submission to the supreme court on Tuesday, as part of a high-profile case being closely watched by the government.

William Mills

APRIL 2, 2025

Fintech companies must be prepared to respond effectively when a crisis strikes. Whether its a data breach, regulatory scrutiny, or a service outage, the way a company handles a crisis can have a lasting impact on its reputation, customer trust and bottom line. The financial services industry, by nature, operates on trust, so making a clear, strategic communications plan is critical.

Advertiser: ZoomInfo

AI adoption is reshaping sales and marketing. But is it delivering real results? We surveyed 1,000+ GTM professionals to find out. The data is clear: AI users report 47% higher productivity and an average of 12 hours saved per week. But leaders say mainstream AI tools still fall short on accuracy and business impact. Download the full report today to see how AI is being used — and where go-to-market professionals think there are gaps and opportunities.

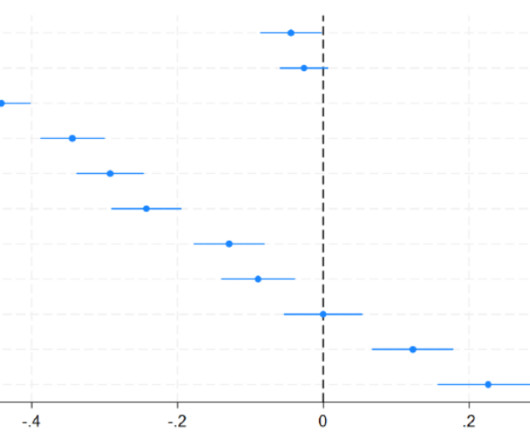

BankUnderground

APRIL 3, 2025

Isabelle Roland, Yukiko Saito and Philip Schnattinger The Bank of England Agenda for Research (BEAR) sets the key areas for new research at the Bank over the coming years. This post is an example of issues considered under the Prudential Architecture Theme which focuses on the evolving regulatory structures and fresh strategic issues for regulators and supervisors.

ABA Community Banking

APRIL 3, 2025

Mets games, live plays, financial escape rooms: Citi's Michelle A. Thornhill and Roads to Success's Bashan Fernandez discuss innovative ways of making financial knowledge fun. The post Podcast: Play ball! Financial education home runs appeared first on ABA Banking Journal.

Payments Dive

APRIL 7, 2025

If approved, the charter would give Stripe the ability to process credit card transactions without a bank partner.

TheGuardian

APRIL 6, 2025

Craig Donaldson challenging ruling by UK regulator, which accused him of misleading investors over 900m accounting blunder The former chief executive of Metro Bank says he has been made untouchable, advised to move to Australia and even had trouble opening bank accounts after the UK regulator accused him of misleading investors over a 900m accounting blunder.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Emmerich Group

APRIL 3, 2025

I believe the world is full of abundance, a field ofdiamonds in every backyard, and you deserve to mine your share. What if you could find and bring in all the deposits you want in your market without having to pay up. Now if you’re the kind of banker who has all the deposits that you want already, you’ll appreciate this because you’ll discover how to bring your cost of funds down even more.

American Banker

APRIL 4, 2025

Banks in the U.S. and India will offer cross-border transactions using the technology that underpins cryptocurrency. Our global payments roundup also includes updates from PayPal, Lloyds and a very remote ATM deployment.

ABA Community Banking

APRIL 1, 2025

Banks are uniquely positioned to jumpstart a positive societal impact and improve the financial health of their communities. The post Three steps banks can take to reverse the financial illiteracy crisis appeared first on ABA Banking Journal.

Payments Dive

APRIL 7, 2025

Large and small businesses alike are still using the 20th-century form of payment extensively, even as the federal government presses ahead with digital alternatives.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

The Paypers

APRIL 1, 2025

Alkami , a US-based provider of cloud-based digital banking solutions, has released research findings on fraud prevention and consumers' perceptions of data protection.

The Emmerich Group

APRIL 3, 2025

Do you agree that high quality customers love high quality attention ? Let’s explore how you can transform your safety and profitability by creating the kind of differentiation that attracts the highest quality credits and makes price irrelevant. If you think that the best customers get the best pricing because everyone wants them, then you have to watch this episode because it can and is being done.

American Banker

APRIL 1, 2025

The buy now/pay later company made a deal with Stride Bank to add banking-as-a-service heft as Affirm Card usage soars and Evolve grapples with defections.

ABA Community Banking

APRIL 1, 2025

Among the deals announced were proposed bank acquisitions in Oklahoma and Tennessee and the merger of two Massachusetts mutuals. The post Bank mergers announced in multiple states appeared first on ABA Banking Journal.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

Payments Dive

APRIL 3, 2025

As companies joust to become the tech giant’s card network, some analysts give Visa and Mastercard an advantage over American Express.

The Paypers

APRIL 4, 2025

Kraken has obtained a Restricted Dealer registration in Canada, allowing it to operate under the regulatory framework set by the Ontario Securities Commission (OSC).

TheGuardian

APRIL 8, 2025

Bank says it still values inclusivity after bowing to Trump agenda by changing hiring and promotion policy Barclays has ditched gender and ethnicity targets for US staff, making it the latest UK company to bow to Donald Trumps anti-diversity drive. Managers at the US arm of the British lender will no long have to consider how new hires and promotions advance the careers of women and people from minority ethnic backgrounds, who have traditionally been overlooked in the banking sector.

American Banker

APRIL 3, 2025

The first year of Otting's tenure as the New York lender's CEO brought substantial change, but the job isn't done. His goal: to build a powerhouse, profitable regional bank.

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

Let's personalize your content