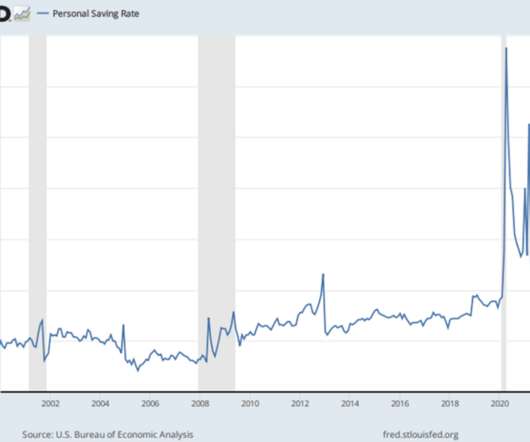

Prepare for stronger C&I lending demand: A $1.7 trillion “wave”

Abrigo

JULY 20, 2024

Ready to catch the next wave of lending growth? Commercial and industrial lending (C&I) will be the next big performance driver for banks and credit unions. You might also like this paper on how institutions can produce smarter, faster lending. C&I lending will be the next “bomb.”

Let's personalize your content