Banks Increase Standards For Consumer, Commercial Loans

PYMNTS

AUGUST 4, 2020

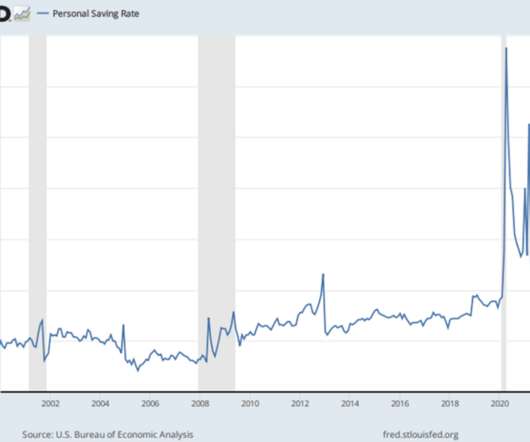

Banks are increasing their standards for loans to businesses and households, according to the Fed’s latest Senior Loan Officer Opinion Survey on Bank Lending Practices. Over the second quarter, major net shares of banks tightened lending standards on all categories of consumer loans.

Let's personalize your content