Klarna creates global ‘Consumer Council’

Bank Innovation

FEBRUARY 13, 2020

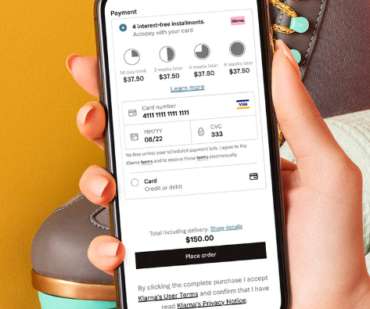

The Sweden-based fintech, founded in 2005 and currently […]. Point-of-sale lender Klarna, which has a banking license in Europe and partners with banks in other markets, is creating a new mechanism to acquire feedback as it evolves its products.

Let's personalize your content