Higher Rates – Faster for Longer

South State Correspondent

OCTOBER 23, 2022

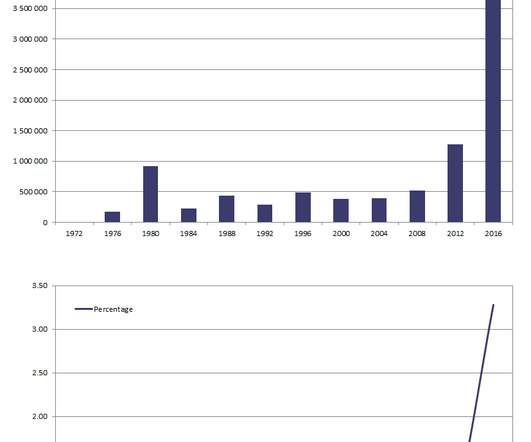

This rapid change in interest rates requires careful planning, product selection, and new lending and deposit-gathering strategies. Jun 2004 – Jun 2006. Application to Community Banks. In today’s lending market, borrowers start from historically low interest rates, making the DSCR deterioration much more likely.

Let's personalize your content