Should You Be Marking Loans To Market?

South State Correspondent

NOVEMBER 7, 2022

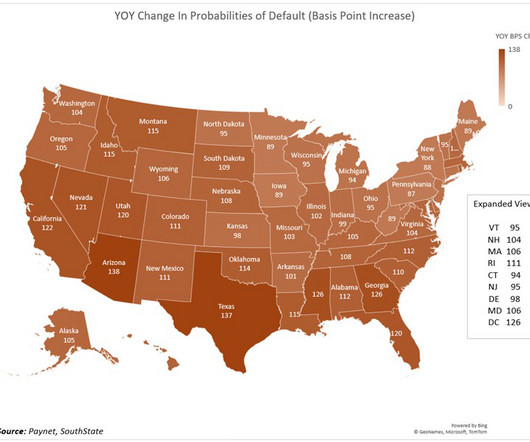

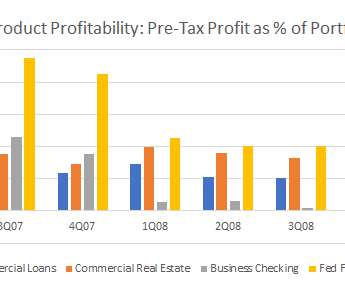

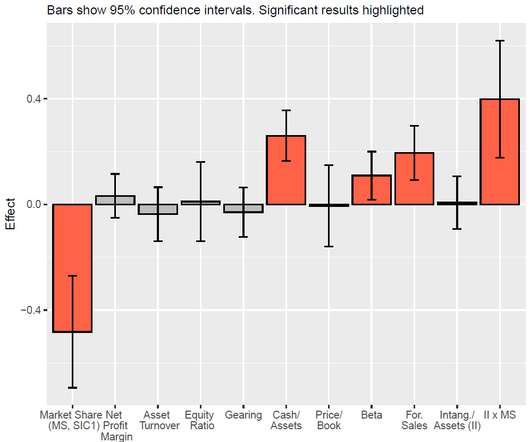

.” That same adjustment can be applied to banks’ fixed-rate loans for economic value analysis to better understand value creation and allocation, prioritize future business activity, and better deploy capital. It was back in August of 2007 when credit spreads started to widen. Capital got scarce. Fast forward to today.

Let's personalize your content