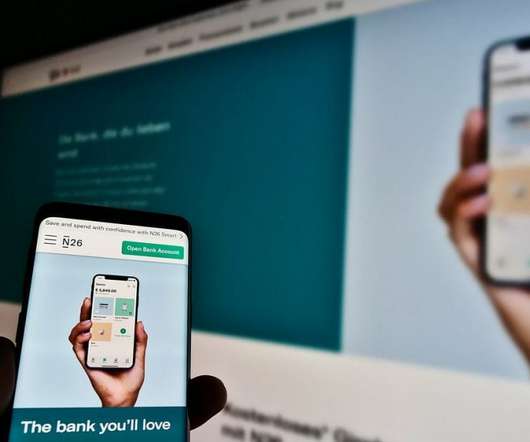

Anthemis’ Williams: Fintechs in a race to become customers’ primary financial provider

Bank Innovation

JUNE 20, 2019

Founded in 2010, London- and New York-based venture firm Anthemis Group focuses on early-stage and Series A fintech investments. Its total deployed and deployable capital amounts to […].

Let's personalize your content