Regulators War on Banking

Jeff For Banks

JUNE 17, 2024

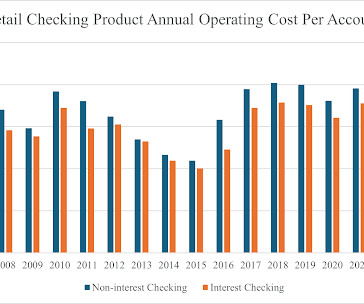

If the CFPB was so concerned about fees charged by banks, perhaps they should perform an analysis of over regulation that is a key contributor to fees charged by banks? Regulators must not have read that article. What do regulators think will happen? I cannot lay the sole blame at the feet of regulators.

Let's personalize your content