Trepp’s Review and Outlook on Commercial Real Estate Market

Abrigo

OCTOBER 21, 2020

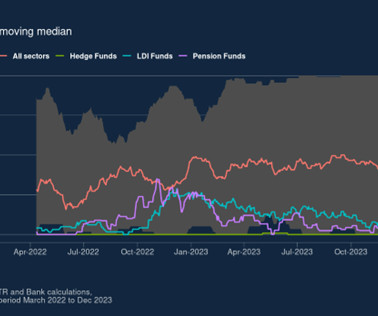

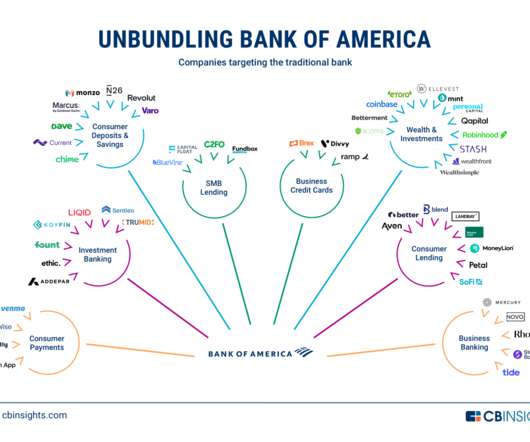

The CMBS delinquency rate reached 10.31% earlier this year, and the peak ever was 10.34% in July 2012 so we reached almost the peak historically but have been slowly decreasing ever since. CRE Lending. Credit Risk Management. Lending & Credit Risk. CRE Lending. Lending & Credit Risk. CRE Lending.

Let's personalize your content