Impact of Covid-19 Felt in the Shared National Credit Reviews Released by Bank Regulators

Perficient

MARCH 10, 2021

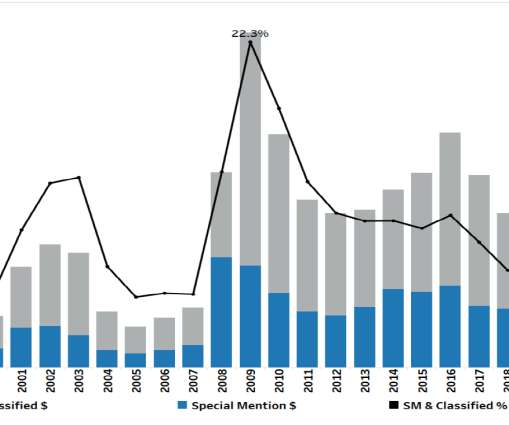

.” SNC (pronounced like the candy bar but without the “ers”) stands for the Shared National Credit Program, which, since 1977, has assessed risk in the largest and most complex credits shared by multiple regulated financial institutions. Total Outstanding.

Let's personalize your content