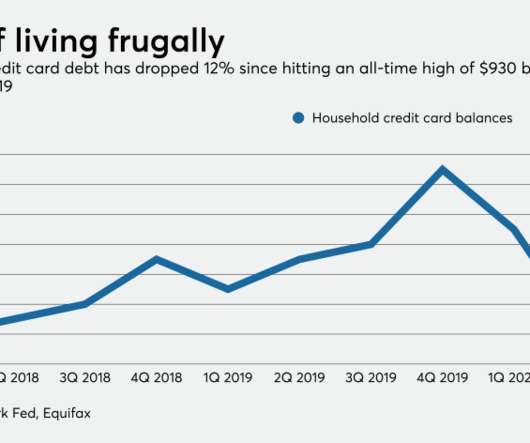

US Household Debt Drops For First Time Since 2014

PYMNTS

AUGUST 7, 2020

household debt for the first time since 2014, the Financial Times (FT) reported. The steep decline in consumer spending resulted in less U.S. At the end of June, consumer debt balances sat at $14.27 trillion, according to figures from the Federal Reserve Bank of New York. That’s a 0.2

Let's personalize your content