2017 Innovators to Watch: 44 Executives Shaping the Future of Banking

Bank Innovation

JUNE 12, 2017

2017 was a tumultuous year, but despite some stops and starts, innovation in finance is only gaining more momentum.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Bank Innovation

JUNE 12, 2017

2017 was a tumultuous year, but despite some stops and starts, innovation in finance is only gaining more momentum.

Bank Innovation

SEPTEMBER 27, 2017

Fintechs are partnering with banks, banks are using blockchain technology, artificial intelligence, and cryptocurrency and financial regulation is still undergoing massive changes. 2017 has been a […].

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Bank Innovation

SEPTEMBER 11, 2017

Russia will start regulating cryptocurrency trading by the end of the year, according to the country’s Finance Minister. It is possible to regulate them, so the […].

Chris Skinner

SEPTEMBER 18, 2017

As mentioned on Friday, they see … The post The regulator’s view of bitcoin, 2017 appeared first on Chris Skinner's blog. These central banks have run trials and are thinking about it, but none of them are particularly big on blockchain right now.

Perficient

MAY 27, 2022

For those wanting to start their own cryptocurrency fund, it’s important to be well informed about cryptocurrency regulations. Regulatory cryptocurrency regulations are most fluid at the state level. State Regulations. SEC Regulation. Central Bank Digital Currency (CBDC) ).

Chris Skinner

JANUARY 20, 2017

The discussion was our regular New Year kick-off meeting with special guest David Doyle, sage of all EU regulations affecting Financial Services. David provided us with great insight into the … The post EU priorities for financial services regulations, 2017 appeared first on Chris Skinner's blog.

Chris Skinner

NOVEMBER 5, 2017

This week’s main blog headlines are … Regulating the unregulated I was thinking about this question of how to regulate global technology platforms that don’t recognise national boundaries, mainly in the context of crypto and digital currencies.

PYMNTS

OCTOBER 15, 2018

As noted by the Conference of State Bank Supervisors (CSBS), state regulators earlier this month released the inaugural Money Services Business Industry Report, which featured transaction data tied to 2017 and focused on licensed money transmission and payments. From a high-level view, the industry handled $1.2 GDPR Fines Loom.

Chris Skinner

SEPTEMBER 3, 2017

This week’s main blog headlines are … Slow regulations versus fast tech Before 2010, I was writing a lot about technology but it was all heavily geared towards regulations. It was pretty dull, to be honest, but worthy.

Bank Innovation

MAY 9, 2017

Startups that promise to change the face of regulation have been in the fintech spotlight lately (see our regtech watchlist here). At the current run rate, 2017 would be the first year “that both deals and dollars decline, and could drop to a […]. But the deal activity seems to have slowed down for the sector.

Perficient

MARCH 10, 2021

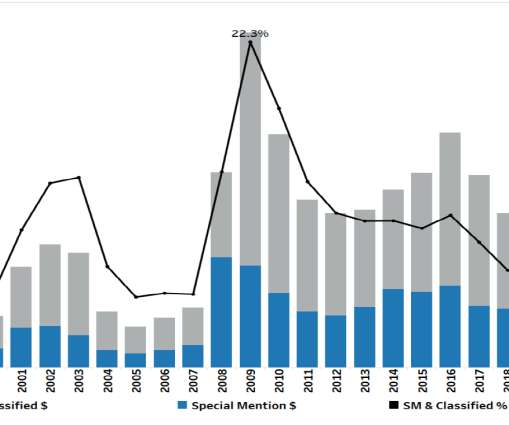

.” SNC (pronounced like the candy bar but without the “ers”) stands for the Shared National Credit Program, which, since 1977, has assessed risk in the largest and most complex credits shared by multiple regulated financial institutions. Loan reviews are completed in the first and third calendar quarters each year.

Chris Skinner

SEPTEMBER 21, 2017

Things we’re reading today include … Fake website fools Equifax staff Challenger bank Paragon restructures as it bids to go mainstream Hack of Wall Street regulator rattles investors, lawmakers Invisible threat ‘Payment by vein’ trialled in supermarket Banks to carry out immigration checks on customers Young shoppers want to (..)

Chris Skinner

NOVEMBER 8, 2017

Regulator could open banking to tech giants Revolut is applying for a European banking license to become a true bank State Bank of India Launches Blockchain Technology-Based Know … The post Things worth reading: 9th November 2017 appeared first on Chris Skinner's blog. Facebook Financial?

Chris Skinner

SEPTEMBER 5, 2017

China regulators target ‘systemic risk’ from money-market … The post Things worth reading: 5th September 2017 appeared first on Chris Skinner's blog.

PYMNTS

NOVEMBER 16, 2018

16) that the practice still fell in popularity in 2017. percent in 2017 per the flow of SWIFT interbank payment messages. percent cumulatively from the beginning of 2011 to the conclusion of 2017. But the checks by banks help to quell these kinds of violations, so the situation has caused frustration for regulators.

Chris Skinner

APRIL 16, 2017

Our love and belonging is … Not all US banks are against Open Banking I blogged recently about American banks beating up the regulators to stop account access via APIs. Barclays board reprimands boss Jes Staley as … The post The Finanser’s Week: 10th April – 16th April 2017 appeared first on Chris Skinner's blog.

PYMNTS

SEPTEMBER 18, 2017

The credit bureaus were included in the CFPB’s scope of oversight in 2012, and she’s asked the agency to let her know what additional power it might need to better regulate the credit reporting agencies going forward. Its February 2017 report , posted on its website, highlighted credit reporting complaints. They are not.

PYMNTS

JULY 2, 2020

The president of the Federal Financial Supervisory Authority (BaFin), Germany’s financial regulator, said the $2.1 But EY, Hufeld and regulators are facing scrutiny over how the once high-flying company managed to escape the industry’s standard accounting rules. It is plain vanilla, old-fashioned criminal behaviour,” Felix Hufeld said.

Chris Skinner

MARCH 15, 2017

The regulator has tried to encourage more competition in the sector by implying the process to launch a new bank, a challenger bank. Since 2010, 19 new retail and commercial banking licenses have been issued, with at least eight more pending as at January 2017.

PYMNTS

JANUARY 26, 2021

MobileCoin complements the privacy-focused app in that it is “more resistant to surveillance,” according to a 2017 Wired report. The MB noted that the new framework clarifies that virtual asset transactions should be treated as cross-border wire transfers, and VASPs must comply with BSP’s wire transfer regulations, the release stated.

Perficient

MARCH 10, 2022

We’re one of Acquia’s first Certified Drupal Cloud Practices and a valued Acquia partner since 2017. Our engagements range from implementing Drupal websites and portals to strategizing personalization and customer journeys, including clients in regulated industries like healthcare and financial services.

PYMNTS

JUNE 29, 2020

Numerous regulators had discussions over the years about tightening supervision on Wirecard or adding it to a list of potential subjects for more investigations, but all decided against it, Reuters reports. Putting it under the umbrella of financial firms would have put the whole company under bank regulation.

Perficient

APRIL 14, 2022

FINRA started publicly disseminating 144A securities in 2014, and as of July 2017, firms are required to report certain transactions in U.S. European MiFID II regulations, which are similar to TRACE for European corporate bonds, were implemented in 2018). Treasury Securities to TRACE. Interested in learning more?

PYMNTS

JANUARY 27, 2020

It will also move Singapore into a more competitive space with Japan, which has seen 22 cryptocurrency licenses since 2017. 30), it will serve as detailed regulation for cryptocurrency firms — for activities ranging from digital payments to the trading of coins like bitcoin and ether.

PYMNTS

JULY 31, 2020

Regulators in China are preparing to move against once-hot Luckin Coffee Inc. In May, the Journal reported extensively on problems at Luckin , which was founded in 2017 and had been growing at a scalding pace. which admitted booking millions of dollars in nonexistent sales, The Wall Street Journal reported on Friday (July 31).

PYMNTS

JULY 15, 2020

The European Securities and Markets Authority (ESMA), the European Union’s (EU) financial watchdog, plans to examine how German regulators handled oversight of Wirecard AG , the collapsed payments company that is facing a series of criminal allegations. ESMA said they will conclude the inquiry by the end of October.

Chris Skinner

JANUARY 13, 2017

Keynote speech … The post 2017 – a decisive year for retail payment services in Europe appeared first on Chris Skinner's blog. It has some key announcements in there, so I’m reproducing the speech here for those interested in immediate payments and what Europe is doing.

PYMNTS

AUGUST 3, 2020

The Financial Times reported that Wirecard’s relationship with CenturionBet ended in 2017, “when its gambling license was suspended by Maltese authorities and it ceased trading after an anti-mafia raid that saw 68 people arrested.” ” Wirecard declined to comment for the FT article. .”

Bank Innovation

DECEMBER 13, 2016

This was a big year for fintech, with new regulations, new startups, and new technologies displayed across events like Sibos and Money20/20, making it clear that the progress of fintech can’t really be stopped. It’s almost time to wave goodbye to 2016. But how will it continue? That’s the real Read More.

PYMNTS

JUNE 30, 2020

A summary of Wirecard ’s customers in 2017 suggests that just 100 clients represented over 50 percent of its real sales, the Financial Times reported, citing an internal spreadsheet. The firm reportedly said it worked with 170,000 small companies and 33,000 large and medium-sized merchants in 2017.

Chris Skinner

JUNE 16, 2017

And unlike an IPO, there is little or no government regulation of an ICO. As of May 2017 there were currently around 20 offerings a month, and a new web browser Brave’s ICO generated about $35 million in under 30 seconds. “The first ICO was for Mastercoin in 2013. Ethereum raised money with an ICO in 2014.

PYMNTS

OCTOBER 8, 2018

The impact of Europe’s General Data Protection Regulation ( GDPR ) continues to take shape roughly five months after taking effect, and Facebook could be on the hook for billions of dollars in fines tied to a data breach of about 50 million user accounts. Crypto Regulations. billion over the corresponding period.

PYMNTS

MARCH 25, 2019

The bipartisan bill proposes several changes to how connected devices are treated, including general recommendations, standards and regulations for greater user protections. The new bill is an upgrade from one introduced in 2017, but the discussion has picked up in recent years. “If IoT’s expansion presents security challenges.

Cisco

NOVEMBER 1, 2022

In 2017, New York Department of Financial Services (NYDFS) passed cybersecurity regulation 23 NYCRR 500, requiring all financial services companies to implement multi-factor authentication (MFA). According to the NYDFS cybersecurity regulations, there are common MFA violations that have occurred across financial service organizations.

PYMNTS

FEBRUARY 11, 2019

As the payments landscape evolves and becomes ever more digital in scope, and as FinTech firms make inroads into traditional financial services, regulators are looking at FinTech credit — and how it might be defined and shaped. There seem to be no easy answers on just how to regulate the space. trillion.

PYMNTS

NOVEMBER 4, 2020

According to the release, the crimes took place between August 2017 and May 2019, at which time Fagundes and other defendants solicited funds from prospective investors online, sometimes using the phone to do so as well, promising innovative investment opportunities in cryptocurrency.

Chris Skinner

JANUARY 7, 2018

In mid-December 2017, the UK’s Financial Conduct Authority (FCA) published a really interesting 32-page paper on Distributed Ledger Technology (DLT).

PYMNTS

SEPTEMBER 14, 2018

To challenge the Office of the Comptroller of the Currency (OCC)’s decision to allow online payment companies and lenders to have national bank charters, the top banking regulator in New York is suing the federal government. Cuomo on June 1, 2017 required DFS to study online lending in New York State and submit a report of its findings.

Bank Innovation

OCTOBER 18, 2017

EXCLUSIVE- APIs and open banking might be becoming more integral to financial institutions, but it doesn’t seem like banks are really working to push innovation in that space That’s according to Bank Innovation’s annual State of Banking Innovation for 2017, where none of the survey’s 151 respondents (the majority of whom are bankers) indicated that (..)

PYMNTS

AUGUST 19, 2019

There are billions of devices in the world helping to monitor and regulate everything from room temperatures to restocking the fridge. percent: Projected CAGR of the IoT analytics market from 2017 to 2025. Devices are everywhere – and are now intelligent and interacting with us through all manner of daily routines.

PYMNTS

APRIL 9, 2019

The revised list now includes mining for bitcoin among more than 450 other practices that the National Development and Reform Commission said should be removed because they didn’t meet current laws and regulations, were deemed unsafe, wasted resources or harmed the environment. The public comment period ends on May 7, reported Reuters.

PYMNTS

DECEMBER 12, 2018

The number of merchants accepting card payments around the world grew by 13 percent in 2017, to 69.2 The growth was partly driven by new regulations; India was helped along by the government placing caps on terminal charges and also pressuring banks to recruit more merchants. million, according to a report.

Bank Innovation

APRIL 7, 2017

More than 80% of financial incumbents anticipate developing more partnerships with fintechs in the next five years, according to PwC’s 2017 Global Fintech Report. Fintechs are becoming more entrenched into the financial ecosystem, with the majority of banks now firmly on the side of collaboration, rather than conflict.

PYMNTS

MAY 1, 2020

Financial institutions (FIs) and regulators in Singapore, the E.U. Regulators may have shifted their focuses away from these initiatives and toward making sure their customers have the financial access they need to survive the pandemic, but the long-term goals of. and the U.S. Similar to the U.K. 18, 2019, Choi continued.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content