Top Banking Challenges: Finding Growth in 2021 and Beyond

Abrigo

MARCH 24, 2021

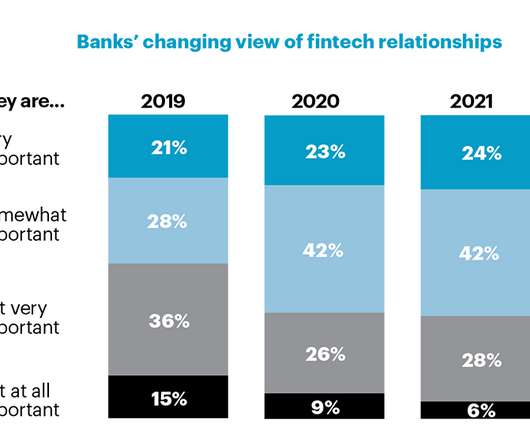

Takeaway 1 Financial institutions that invested in technology in 2020 are using it to increase the loan portfolio in 2021. Growing loans, earnings are banks' top challenges in 2021. The top banking challenges in 2021 are growing loans and earnings, according to Independent Banker’s recent 2021 Community Bank CEO Outlook survey.

Let's personalize your content