2022 Dodd-Frank Stress Test Scenarios Released

Perficient

MARCH 3, 2022

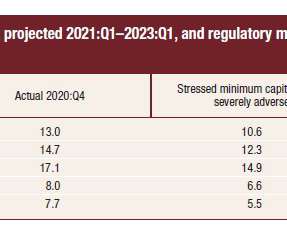

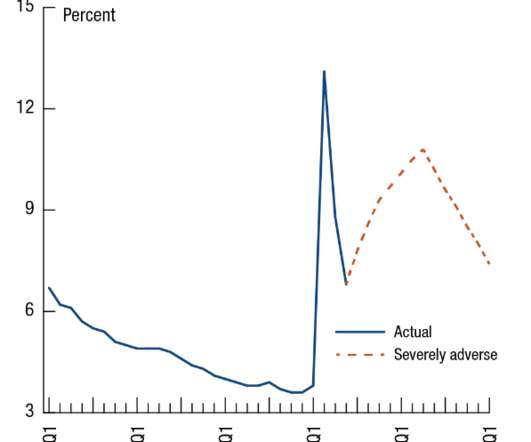

The Office of the Comptroller of the Currency (OCC) recently released the economic and financial market scenarios that will be used in the upcoming stress tests for covered institutions. Equity market volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), declines in 2022 by about 6.5

Let's personalize your content