CFPB issues 2022 Annual Fair Lending Report

CFPB Monitor

JULY 5, 2023

The CFPB recently issued its annual fair lending report covering its fair lending activity in 2022.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Perficient

MAY 5, 2022

While it was once expected and acceptable for lenders to enforce standardized payment due dates and policies, COVID-19 brought the impracticality and ineffectiveness of a “one-size-fits-all” approach to credit and lending to light. The IDC Market Glance offers an overview of the landscape for consumer and small business digital lending.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

DECEMBER 22, 2023

The most-read lending & credit blogs in 2023 Probability of default, CECL model validation, and stress testing were among Abrigo's top blogs on ALM, CECL, and portfolio risk this year. You might also like this resource, Abrigo's "2022 Loan Review Benchmark Survey Results."

Abrigo

APRIL 25, 2024

Recent data and trends of the small business lending market SMB Lending Insights is a snapshot of current financial trends and metrics that impact small and medium-sized business (SMB) lending and financial institutions. You might also like this guide for smarter, faster small business lending.

Advertisement

Despite some turbulence in the second half of 2022, CRE performed relatively well. We know and understand commercial lending and commercial real estate, we know that in times like these, lenders can and should, shift focus. What to expect? With today's market as it is, where should commercial lenders shift their focus?

Perficient

JANUARY 18, 2022

Everywhere you look and read, we are reminded of the key drivers behind the rising debt and delinquencies Americans face, as well as indications there’s much more to come: Inflation increased at the fastest rate in 40 years over the last twelve months, exceeding expectations, the Labor Department announced on January 12, 2022.

Abrigo

APRIL 22, 2024

Recent dynamics of the small business lending market A deep understanding of the small business lending landscape and potential efficiencies can help banks and credit unions grow their portfolios. You might also like this guide for smarter, faster small business lending. Record new business formation and a wider gap between U.S.

Abrigo

MAY 22, 2024

Recent stats and dynamics of the small business lending market Understanding the small business lending landscape and potential efficiencies can help banks and credit unions grow their portfolios. You might also like this guide for smarter, faster small business lending. Record new business formation and a wider gap between U.S.

Abrigo

JULY 25, 2022

Strong demand is a factor in the ag lending outlook ahead Ag lenders can begin taking steps to ensure they are prepared and can provide positive customer or member experiences. The outlook for ag lending has its share of uncertainty. Inflation, rates are factors in ag lending outlook. Farmers expect worse in 2023. Rising inputs.

Abrigo

DECEMBER 23, 2022

Blog posts to help your asset/liability management (ALM) staff strategize for the future These ALM posts were the most popular in 2022. Navigating a rising-rate environment, leveraging core deposit strategies, and pricing loans effectively were top of mind for asset/liability management (ALM) staff in 2022. Lending & Credit Risk.

SWBC's LenderHub

JANUARY 24, 2022

Semiconductor supply chain issues caused major headaches for auto lenders throughout 2021 and vehicle production continues to suffer into 2022. In this blog post, we’ll take a deep dive into how demand for computer chips is expected to impact auto sales in the coming months.

Perficient

MARCH 3, 2022

Federal bank regulators work together to design Comprehensive Capital Analysis and Review (“CCAR”) stress tests that are designed to ensure that even in the case of a severe recession, significant banks can lend to households and businesses. Ten-year Treasury yields increase from around 1.5% to hover around 2.50

Abrigo

FEBRUARY 7, 2023

How construction administration units mitigate construction lending risk Construction lending involves unique risks and requires specialized processes. WATCH Takeaway 1 The OCC recommends that construction lending risk be managed by specialized real estate and construction lenders who report to the credit department.

CFPB Monitor

OCTOBER 2, 2023

The CFPB recently released a report entitled Data Point: 2022 Mortgage Market Activity and Trends based on 2022 data reported by lenders under the Home Mortgage Disclosure Act (HMDA).

Abrigo

MARCH 17, 2022

The Stress Test Scenarios for Big Banks Are Useful for Smaller Institutions' Own Tests Banking regulators recently released the 2022 scenarios for upcoming stress tests by the biggest banks. The 2022 stress test scenarios provide a blueprint for community banks and credit unions to get started on their own stress tests.

CFPB Monitor

DECEMBER 15, 2022

The Federal Reserve System, through its Consumer Compliance Outlook platform, recently hosted its annual Fair Lending Interagency Webinar. During the session, a variety of fair lending topics were discussed, including redlining, appraisal bias, and Special Purpose Credit Programs (SPCPs),

CFPB Monitor

JUNE 9, 2022

Proponents of the Payday Loan Interest Rate Cap ballot initiative in Michigan met the June 1, 2022 deadline to appear on the November 2022 ballot in the state. Michiganders for Fair Lending – the initiative’s sponsor – collected over 570,000 signatures of which it submitted (after a quality control process) 405,265.

CFPB Monitor

JUNE 12, 2023

The Federal Trade Commission has provided its annual report to the CFPB on its enforcement and related activities in 2022 regarding the Truth in Lending Act (TILA), Consumer Leasing Act (CLA), and Electronic Fund Transfer Act (EFTA) (collectively, the “Financial Acts”). It also released its 2022 annual report on refunds. .

Abrigo

FEBRUARY 23, 2022

Loan Decisioning Allows Small Business Lending to Grow Community financial institutions can leverage automated loan underwriting to increase small business lending and achieve consistency. . Takeaway 2 Loan decisioning allows institutions to efficiently allocate credit analysts’ time for profitable small business lending.

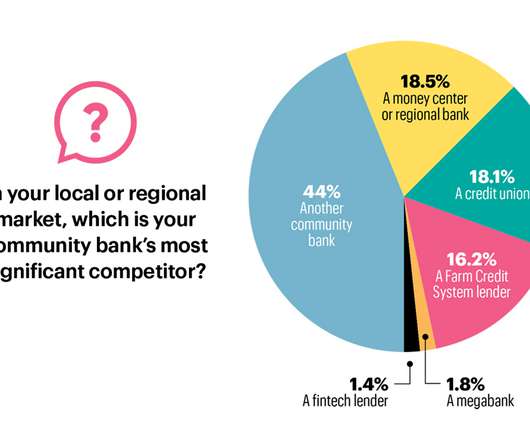

Independent Banker

APRIL 30, 2022

Loan providers share an infectious enthusiasm and growing optimism for one vertical’s prospects in 2022: commercial lending. Here’s how community bankers can take advantage of various sectors—including SBA lending—over the next 12 months. anticipates a low double-digit increase in its commercial lending in 2022.

Bobsguide

MAY 18, 2022

Congratulations to the entire CompatibL team for winning our Best Risk Management Platform Award for 2022.”. The 2022 FinTech Breakthrough Awards program attracted more than 3,950 nominations from across the globe. The post CompatibL Wins at the 2022 Fintech Breakthrough Awards appeared first on Bobsguide.

SWBC's LenderHub

APRIL 25, 2022

As we enter into Q2 2022, the already strong used vehicle market is expected to heat up. Experts at Cox Automotive predict the coming months will be the strongest part of the year for vehicle sales:

CFPB Monitor

JULY 6, 2022

The CFPB has published its Spring 2022 rulemaking agenda as part of the Spring 2022 Unified Agenda of Federal Regulatory and Deregulatory Actions. Even the two items that appeared as long-term actions in the Fall 2021 agenda, artificial intelligence and mortgage servicing, no longer appear in the Spring 2022 agenda.

Gonzobanker

DECEMBER 7, 2023

It’s time for banks and credit unions to finally execute those C&I lending priority initiatives. Senior bank and credit union executives have ranked commercial and industrial (C&I) loans as a top lending priority over the past several years in Cornerstone Advisors’ annual What’s Going On in Banking research.

Abrigo

FEBRUARY 25, 2022

Personalized Touch with Efficient Service Can Boost Lending Banks and credit unions can boost business lending by combining a relationship focus with transaction-oriented processing. . This competition can only increase as the lending landscape continues to shift. Streamlined, Quick. Win more business loans you want.

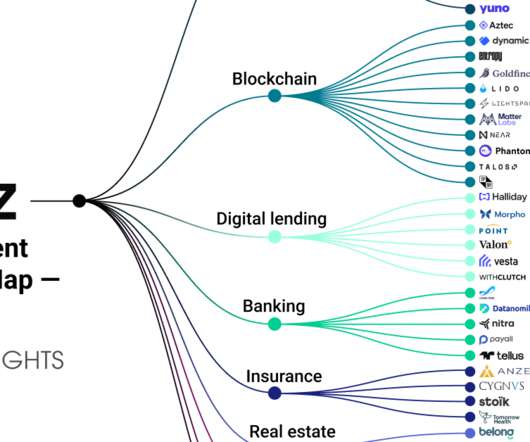

CB Insights

JANUARY 26, 2023

The fintech industry took a hard hit in 2022 as investors scaled back their investments amid market turmoil. DOWNLOAD THE STATE OF FINTECH 2022 REPORT Get the latest data on global fintech investment trends, the unicorn club, sectors from banking to payments, and more. Fintech is central to a16z’s investment strategy.

Independent Banker

DECEMBER 31, 2021

What changes will 2022 bring? And as local economies continue to stabilize and many challenged industries bounce back, 2022 may be the year community bankers put the rubber to the road by revisiting goals and turning them into action items. What will drive profit in 2022? Janet Silveria, Community Bank of Santa Maria.

CFPB Monitor

JULY 5, 2023

The Federal Financial Institutions Examination Council (FFIEC) recently announced the release of the 2022 Home Mortgage Disclosure Act (HMDA) data. The CFPB also released a summary of the data. Continue Reading

FICO

DECEMBER 15, 2021

In 2022 consumers will increasingly expect to be able to service all of their requirements, however complex, online. As economic activity rebounds, people are facing elevated levels of inflation with potential increases in interest rates forecast in early 2022, as well as higher energy prices.

Abrigo

APRIL 24, 2023

Construction loans grow, delinquencies flatten in 2023 Construction lending projections look positive according to S&P data from 2022 and 2023. Construction lending has seen several stumbling blocks over the past few years. Construction loan delinquencies Delinquency rates balanced out The end of 2022 saw $2.54

Independent Banker

JUNE 30, 2022

As we kick off this year’s lending issue, I want to pause for a moment to reflect on just how much lending has changed. I’ll be attending the 2022 Idaho, Nevada, Oregon and Washington Bankers Associations’ Annual Convention in Coeur d’Alene, Idaho, and meeting with ICBA’s board of directors. Where I’ll be this month.

Independent Banker

JUNE 30, 2022

Here, we highlight some of last year’s most successful loan producers in the areas of agriculture, commercial and consumer/mortgage lending. The score combines the average of the bank’s percentile rank for lending concentration and for loan growth over the past year in each lending category. By Ed Avis. Methodology. AGRICULTURE.

BankInovation

MARCH 25, 2022

In this Weekly Wrap episode of “The Buzz” podcast, the Bank Automation News team discusses the recent Bank Automation Summit 2022 with recorded excerpts from the panel “Modernizing Commercial Lending Through Automation.” This episode […].

PYMNTS

MAY 5, 2020

Digital lending marketplace BitX Funding , which matches business owners and non-bank lenders, is aiming to help Amazon third-party (3P) sellers grow. Rowe noted, “Large banks and other lenders don’t recognize the assets of 3P sellers, as their inventories sit with Amazon.

Bobsguide

APRIL 21, 2022

Finastra appoints Isabel Fernandez to accelerate lending business growth. Company welcomes Isabel to the Finastra leadership team, as EVP, Lending Business Unit. The post Finastra appoints Isabel Fernandez to accelerate lending business growth appeared first on Bobsguide. I’m looking forward to getting stuck in.”. Paddington.

CFPB Monitor

AUGUST 11, 2022

The FHFA announced that Fannie Mae and Freddie Mac will require mortgage servicers to maintain certain fair lending data elements, including the borrower’s age, race, ethnicity, gender, and preferred language. The fair lending data must be stored in a searchable format, and must transfer with servicing throughout the loan term.

Abrigo

JUNE 29, 2022

Takeaway 2 Surging commodity prices have been expected to drive agricultural sector receipts higher in 2022. . farmers is even more unpredictable than in recent years, so financial institutions will want to keep a close eye on the agricultural sector -- both to protect ag lending portfolios and tap into ag loan growth opportunities.

ABA Community Banking

MAY 16, 2022

The Community Development Financial Institutions Fund today opened its funding round for fiscal year 2022 funding for its small-dollar loan program. The post CDFI Fund Now Accepting Applications for Small-Dollar Lending Program Funds appeared first on ABA Banking Journal.

BankInovation

DECEMBER 27, 2022

Technological innovation has taken the auto industry by storm since the start of the COVID-19 pandemic by automating lending operations and addressing consumer pain points in the car-buying process to improve the end-to-end purchasing experience.

The Financial Brand

OCTOBER 20, 2021

The post Top Mortgage Lending Trends for 2022 appeared first on The Financial Brand - Banking Trends, Analysis & Insights. Despite some uncertainty over the duration of the home buying boom, banks and credit unions must adapt to technology and demographic changes.

SWBC's LenderHub

AUGUST 11, 2022

With a recession on the horizon, the landscape for financial institutions will become more difficult for the rest of 2022 and into 2023. Rising delinquencies, tighter margins driven by an inverted yield curve, and softening loan demand due to higher rates will pose a series of challenges.

ABA Community Banking

JANUARY 5, 2022

What's on the community bank roadmap for digital process improvement in 2022? The post Podcast: The Community Bank Digital Transformation Roadmap for 2022 appeared first on ABA Banking Journal.

Independent Banker

FEBRUARY 28, 2022

As we look into 2022, expert opinions on the direction of interest rates are mixed. Les Parker, Managing Director for Transformational Mortgage Solutions for example, predicts that interest rates could fall temporarily below 1 percent in 2022 as continued COVID outbreaks spark economic uncertainty. How to turn insight into action.

CFPB Monitor

APRIL 12, 2023

In the March 2023 issue of Consumer Compliance Supervisory Highlights , the FDIC discusses consumer compliance issues identified by its examiners during supervisory activities conducted in 2022 involving referral arrangements, trigger leads, servicemember protections, and fair lending compliance. Compliance Issues.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content