Perficient Included in IDC Market Glance: Lending Digital Transformation Strategies

Perficient

MAY 5, 2022

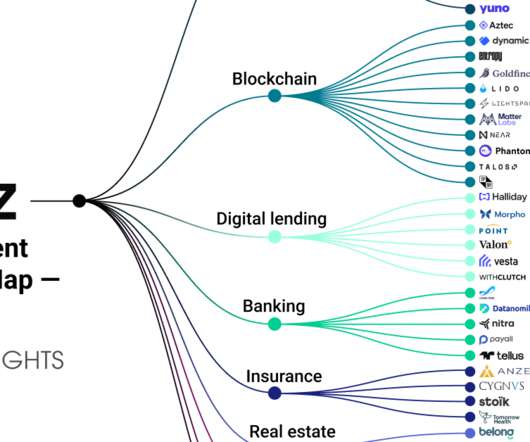

IDC recently included Perficient in the “Loan Collections-Recovery” category of its “ Market Glance: Worldwide Consumer & Small Businesses Lending Digital Transformation Strategies, Q2 2022 (Doc # US49009422, April 2022).” A Pathway to Improved Loss Rates and Happier Customers.

Let's personalize your content