The top lending & credit risk blogs of the year

Abrigo

DECEMBER 22, 2023

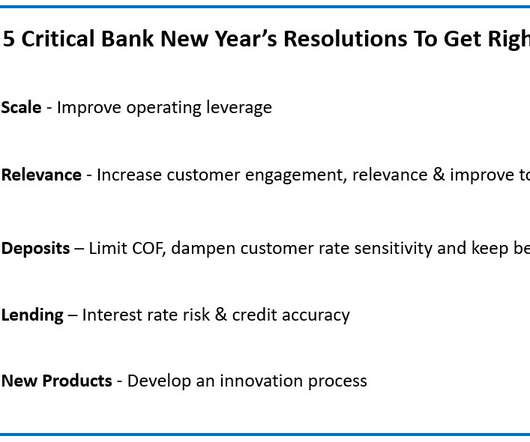

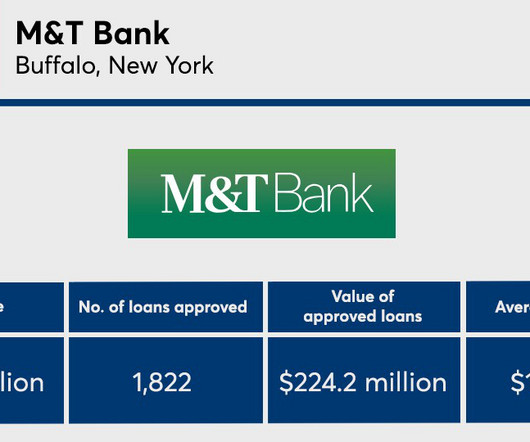

The most-read lending & credit blogs in 2023 Probability of default, CECL model validation, and stress testing were among Abrigo's top blogs on ALM, CECL, and portfolio risk this year. download NOW Takeaway 1 The most popular blog posts on the Abrigo site reflect many of the priorities community banks and credit unions had in 2023.

Let's personalize your content