1Q 2023 Loan Pricing Update

South State Correspondent

JANUARY 20, 2023

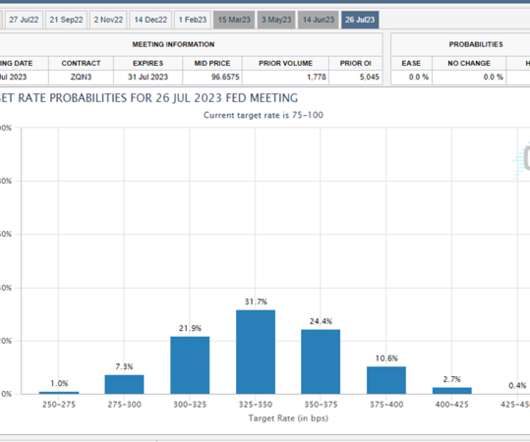

2022 will go down as one of the worst years for community bank loan mispricing when viewed on a spread basis. ROE Targets Moved up in 2023 As was the theme for most of 2022, the target risk-adjusted return on equity increased from 15% at the start of 2022 to 24% at the beginning of 2023.

Let's personalize your content