Cloud Takes Center Stage at 2023 Bank Automation Summit

Perficient

MARCH 30, 2023

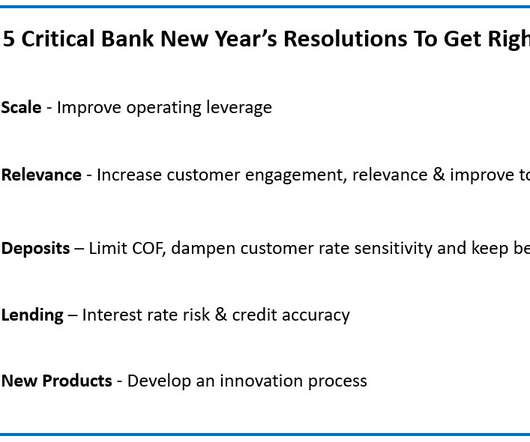

Recently, I attended the 2023 Bank Automation Summit , where one of the significant topics of discussion was how banks navigate their transition to the cloud. Compliance Financial services institutions must be hypervigilant regarding where customer data is located, who has data access, and how data is managed in a cloud environment.

Let's personalize your content