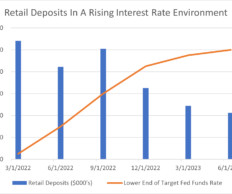

Lessons Learned From the Fourth United States Bank Failure of 2023

Perficient

AUGUST 16, 2023

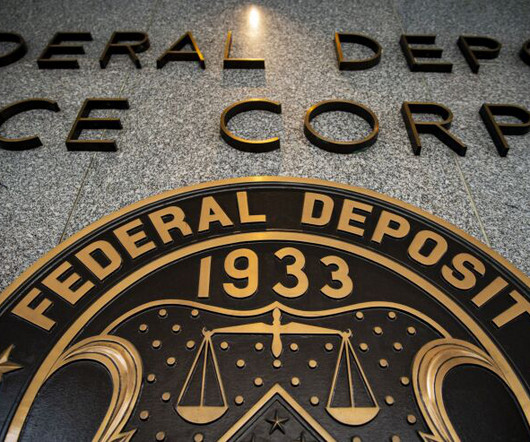

A rather small bank, as of the end of its first quarter, the bank reported $139 million in total assets and $130 million in total deposits in its FDIC Call Report. Herndon named the Federal Deposit Insurance Corporation (“FDIC”) as receiver, allowing the FDIC to take control of the Heartland Tri-State’s operations.

Let's personalize your content