5 Banking Trends We’re Forecasting for 2023

Perficient

JANUARY 25, 2023

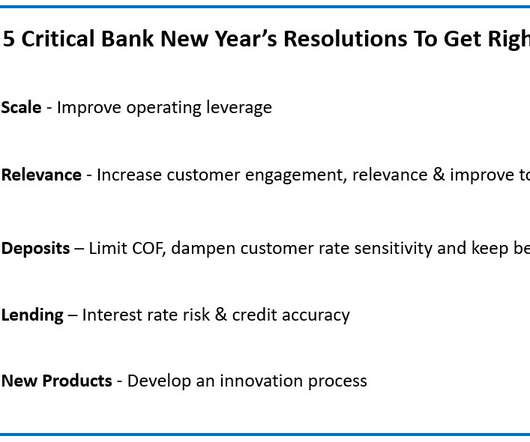

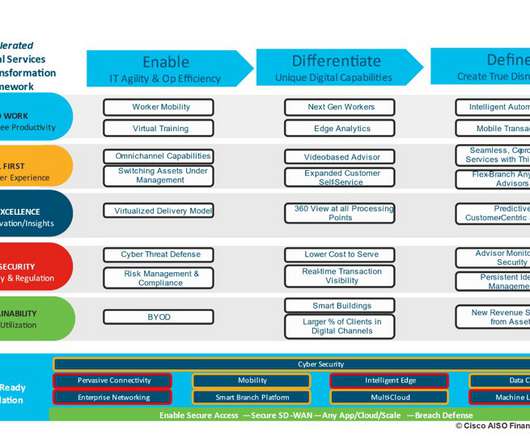

2023 has commenced, and rates are climbing, inflation is bubbling, and banking customers are continuing to demand hyper-personalized products and experiences from their institutions. Banks are focused on efficiency initiatives to optimize their operations and lower costs.

Let's personalize your content