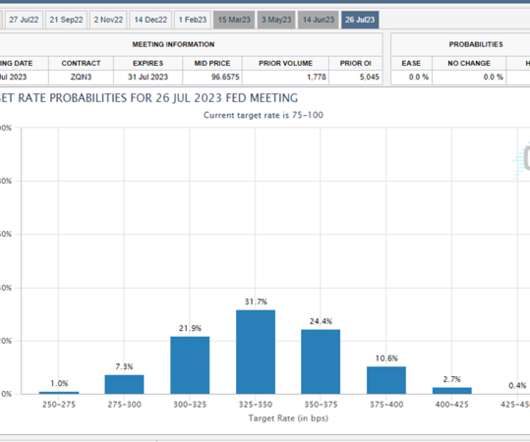

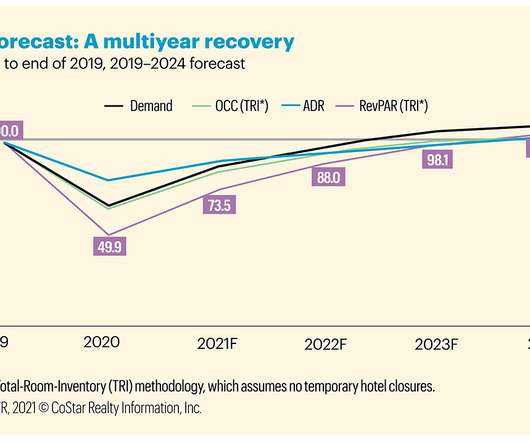

Managing interest rate risk in 2024: Strategies for community banks

Abrigo

JUNE 28, 2024

Takeaway 2 Abrigo advisory expert Susan Sharbel offers insights into where your bank should focus its resources to manage interest rate risk, Takeaway 3 Practical steps for preparing your ALM program for rate changes include updating and validating risk models regularly, conducting tests, and reviewing portfolios. Upcoming exam?

Let's personalize your content