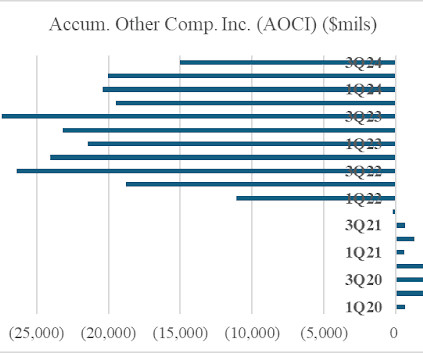

Acquisition and integration considerations for banks in 2024

Abrigo

JANUARY 24, 2024

Account for the details before your FDIC bank acquisition Consider these tips for assessing your institution and a to-be-acquired institution for a smooth integration You might also like this webinar, "Valuation and purchase accounting: Navigating the changing M&A landscape."

Let's personalize your content