BNZ protects customers (and the customer experience) with IBM Safer Payments

Insights on Business

MAY 22, 2019

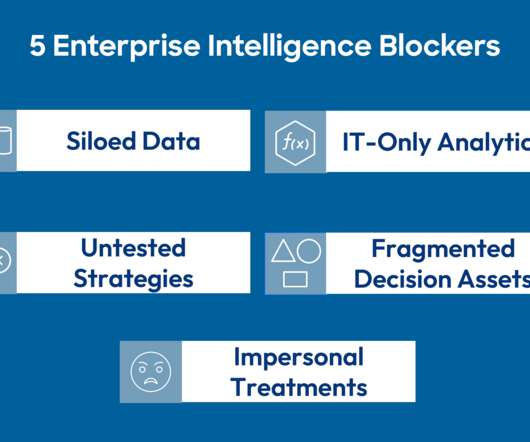

Many conveniences that customers enjoy as a result of modern banking carry an increased risk of fraud. Global card fraud losses are on the rise—from 2016 to 2025, they are projected to nearly double, climbing from US $22.8 Protecting customers and the customer experience. Growing fraud requires new approach.

Let's personalize your content