Ally lays off hundreds of employees

Payments Dive

JANUARY 10, 2025

The digital bank also said this month that it’s exploring strategic alternatives for its credit card business.

Payments Dive

JANUARY 10, 2025

The digital bank also said this month that it’s exploring strategic alternatives for its credit card business.

ATM Marketplace

JANUARY 10, 2025

Bradley Cooper, podcast host, spoke with Felix Nater, security expert and owner of Nater Associates LTD, about how banks can successfully implement safety plans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Perficient

JANUARY 8, 2025

Its difficult, in the consulting services industry, to explain the requirement for existence of a core thought leadership group to augment the sales and marketing teams that are tasked with collection of logos. In todays hypercompetitive and fast evolving marketplace, the lines between thought leadership and sales are increasingly intertwined… Thought leadership, when done right, isnt just about looking and talking smart (though thats nice).

Jack Henry

JANUARY 7, 2025

Uncover how to copy data efficiently to save time and costs with your data conversion! Discover innovative data copy solutions for financial institutions.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

ABA Community Banking

JANUARY 9, 2025

The ABA Foundation offers resources for bank customers and employees on how to recover financially from disasters and on how to avoid scammers who prey on disaster victims and people seeking to donate to recovery efforts. The post Resources for banks to assist customers, employees affected by California wildfires appeared first on ABA Banking Journal.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

JANUARY 10, 2025

Executives acknowledge not everyone will agree with this decision as bank calls time on remote and hybrid working JPMorgan Chase is summoning all staff back to the office, becoming the latest corporate giant to call time on era of remote and hybrid working sparked by the Covid-19 pandemic. The USs largest bank, which has some 316,000 employees worldwide, announced on Friday that all workers on hybrid work schedules will be required to return to the office five days a week from March.

BankBazaar

JANUARY 14, 2025

Looking for the emerging trends in Indias personal finance market? Here are some key insights from the Moneymood 2025 report presented by BankBazaar. BankBazaar.com, an Indian fintech co-brand Credit Card issuer and online financial product marketplace, launched the sixth edition of BankBazaar Moneymood 2025. This report summarises personal finance trends from 2024 and outlines expectations for 2025.

ATM Marketplace

JANUARY 7, 2025

Voice technology and its transformative potential took center stage at the Self-Service Innovation Summit 2024, hosted by Networld Media Group in Miami, Florida.

ABA Community Banking

JANUARY 8, 2025

The OCC issued a proclamation allowing national banks, federal savings associations and federal branches and agencies of foreign banks to close offices in areas of California affected by wildfires. The post OCC allows banks affected by California wildfires to close appeared first on ABA Banking Journal.

Advertiser: ZoomInfo

Incorporating generative AI (gen AI) into your sales process can speed up your wins through improved efficiency, personalized customer interactions, and better informed decision- making. Gen AI is a game changer for busy salespeople and can reduce time-consuming tasks, such as customer research, note-taking, and writing emails, and provide insightful data analysis and recommendations.

Payments Dive

JANUARY 14, 2025

The card network entered the agreement to settle a proposed class action that alleged it discriminated against Black, Hispanic and female employees by underpaying them.

The Paypers

JANUARY 8, 2025

The BIS Committee on Payments and Market Infrastructure (CPMI) has announced that it has moved forward with progressing the adoption of its harmonised ISO 20022 data requirements.

BankBazaar

JANUARY 7, 2025

New Year, new goals. Thats what we always say, isnt it? Every January, we start with the best intentions: This is the year Ill get my finances sorted!. But by March, those goals often fizzle out as life takes over. So, how can we set financial goals that actually stickones that survive the chaos and still make a real impact by the end of the year? Start With A Money Audit Before setting any financial goals, its essential to understand where your money is going now.

ATM Marketplace

JANUARY 7, 2025

Read the top 7 news headlines of 2024.

Advertisement

Automation is changing the game for commercial lenders, offering a clear path to competitive advantage in 2025. Rising costs, outdated workflows, and manual data entry slow growth and impact borrower satisfaction. Automation addresses these challenges, reducing costs, speeding up loan cycles, improving accuracy, and elevating borrower experiences. With market uncertainty easing, now is the time to act—waiting until loan volumes rebound leaves lenders unprepared and struggling to compete.

American Banker

JANUARY 8, 2025

The top five banks with the largest portfolios of commercial and industrial loans had more than $1.03 billion when combined.

Payments Dive

JANUARY 10, 2025

The high-speed payments system operated by The Clearing House also saw the value of transactions nearly double last year over 2023.

Jeff For Banks

JANUARY 14, 2025

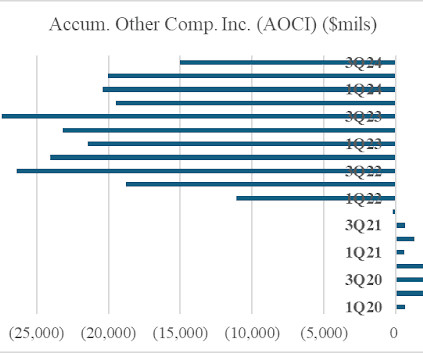

Bank earnings remained below par for 2024 due to continued net interest margin pressures. As a result, many financial institutions amplified their misery by turning unrealized losses in their relatively low-yielding bond portfolios into actual losses by selling their underperforming bonds. In my book, Squared Away-How Bankers Can Succeed as Economic First Responders , I referred to the phenomenon of further impairing already impaired earnings by making strategic investments in your bank as "pull

Jack Henry

JANUARY 8, 2025

Many financial institutions I speak with these days are intrigued by the possibility of becoming a sponsor bank, supporting embedded payments for corporates with high transaction volumes and their fintech partners.

Advertisement

Remote Deposit Capture (RDC) clients are more likely to use additional treasury services and maintain larger deposits. However, poor customer experiences—particularly if they delay deposits—can compel RDC clients to take their business elsewhere. This eBook makes the case for outsourcing RDC operations to a proven managed services partner. This approach helps Treasury Departments with limited resources provide excellent client experiences that result in higher retention and productivity rates.

The Paypers

JANUARY 8, 2025

Nuvei partners with GiG to integrate its payment methods into Gig's PAM platform, CoreX, for improved payment functionality for gamers.

American Banker

JANUARY 13, 2025

Leaders in investment bankingshare a common belief that the sector is standing on the precipice of huge, technology-enabled change.

Payments Dive

JANUARY 9, 2025

Deregulation, artificial intelligence and stablecoin use are among the industry forces that will drive more digital payments use and innovation this year.

TheGuardian

JANUARY 8, 2025

Bank of England says it is rowing back on overcooked regulations introduced after financial crisis The Bank of England plans to slash the reporting burden on UK banks and allow insurers to make riskier investments without initial approval, as it comes under government pressure to ease regulations introduced after the financial crisis. Sam Woods, a deputy governor at the Bank who leads its regulatory arm, the Prudential Regulation Authority (PRA), said the central bank had rowed back on rules tha

Advertisement

Have you ever felt the pain and loss of a client suddenly going silent, leaving you questioning everything? Ghosting can cause heartbreak; in business, it drains resources, and emotionally, it shatters your confidence. A modern credit card program can give you the tools to deliver the digital-first experiences your customer’s demand. Our eBook, “5 Signs Your Credit Card Offering Needs an Upgrade,” will help you identify key indicators that your current card platform may be holding you back and w

Jack Henry

JANUARY 10, 2025

In an increasingly complex financial world, small businesses and large corporations face distinct challenges when it comes to managing their finances. While small businesses may focus on day-to-day operations, cash flow, and financial planning, larger enterprises typically require more sophisticated tools for handling complex treasury functions such as liquidity management, risk mitigation, and large-scale payment processing.

The Paypers

JANUARY 10, 2025

Thailand has decided to trial cryptocurrency payments in Phuket as part of a pilot programme aimed at offering foreign visitors an alternative payment method.

American Banker

JANUARY 9, 2025

Women in the payments industry are using the advent of real-time payment networks to help underserved women around the world gain access to vital financial services.

Payments Dive

JANUARY 9, 2025

The cash advance online platform called the lawsuit “a continued example of government overreach.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

Let's personalize your content