Alivia Analytics scans for healthcare payments fraud

Payments Dive

JUNE 26, 2023

With new leadership installed since October, including a new CEO and board member, Alivia Analytics is fighting payments fraud in the healthcare sector.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JUNE 26, 2023

With new leadership installed since October, including a new CEO and board member, Alivia Analytics is fighting payments fraud in the healthcare sector.

Abrigo

APRIL 2, 2025

Payment fraud: What is it and why the payment system used matters Payments are evolving, and so are fraud tactics. Financial institutions must stay ahead by implementing proactive fraud detection strategies to protect their customers and mitigate losses. Key topics covered in this post: What is payment fraud?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

MARCH 11, 2025

How to prevent internal fraud at your bank or credit union Of the many fraud risks banks and credit unions face, one of the most costly comes from within the institution itself. ACFE reported that 5% of an organizations revenue is lost to internal fraud each year, with an estimated $3.1 billion in total losses.

Perficient

MARCH 17, 2025

Leveraging advanced data analytics , AI, and machine learning can provide real-time insights into customer preferences, behaviors, and financial needs, creating highly individualized experiences that improve engagement and loyalty.

PYMNTS

AUGUST 21, 2020

ATMs are common avenues for fraud, however, especially those that are running outdated software. These machines can be vulnerable to fraud, however, ranging from physical techniques like card skimmers to digital methods like identity theft. Deep Dive: Keeping Digital-First Banking Secure With AI, Biometrics. About The Tracker.

Perficient

OCTOBER 15, 2020

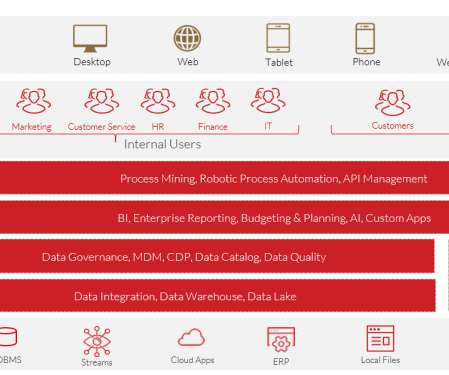

The world of modern data and analytics continues to evolve and is very exciting. They also quietly built out a robust set of services to support any and all use cases related to data and analytics. Outlined below are the Top 10 Things You Didn’t Know about Data and Analytics in the Oracle Cloud: 1.

PYMNTS

OCTOBER 16, 2020

Harnessing consumers’ digital information is critical to the success of any business, and data analytics and artificial intelligence (AI) can be especially powerful tools. Fast-food giant McDonald’s was not interested in using AI or data analytics until it noticed that many of its competitors were benefiting from the technologies.

Abrigo

OCTOBER 22, 2024

Their contributions are massive, and if you’ve ever worked with AML Officers and fraud professionals, you know just how vital they are. Every day, I’m reminded of the critical role the teams at our 2,500 bank and credit union customers play in anti-money laundering (AML), combating the financing of terrorism (CFT), and fraud prevention.

PYMNTS

JANUARY 13, 2021

The prevalence of online commerce opens new doors for digital fraud, however, both from career fraudsters and opportunistic customers. Developments F rom The World Of Digital Fraud. Developments F rom The World Of Digital Fraud. For more on these and other digital fraud news items, download this month’s Tracker.

Perficient

AUGUST 23, 2021

Internally, data creates the foundation for increased analytic application of fraud detection, at-risk customer behavior, and improved cross-functional process management. Perficient predicts that AI / ML will influence 30% of customer interactions within the next year.

PYMNTS

DECEMBER 21, 2020

That's why we call them human analytics. Step number one is, let me see first- and third-party fraud through the behaviors of my applicants that I can't see today,” Alton said. This allows them to start seeing the fraud.”. When we offer Behavior-as-a-Service, we tell people if you have behavioral data today.

PYMNTS

OCTOBER 14, 2020

The October Mobile Order-Ahead Tracker® explores the latest digital ordering developments, including new technology deployments by Burger King and Disneyland , the growing threat of false chargebacks, and how QSRs like Qdoba are harnessing data analytics to reduce chargebacks and drive sales. About the Tracker.

PYMNTS

OCTOBER 19, 2020

Meeting this fraud threat will require in-depth knowledge of fraudsters’ techniques and advanced technology and customer vigilance, according to Jamie Armistead , vice president and business line leader for banking app Zelle. “We We split out scams and frauds,” he explained in a recent interview with PYMNTS.

Perficient

FEBRUARY 27, 2025

Banks can use advanced data analytics and AI to deliver highly personalized financial services, such as customized savings plans and tailored investment advice. Recommended Approach: Banks should leverage advanced data analytics, artificial intelligence (AI) , and machine learning (ML) to create highly individualized experiences.

South State Correspondent

APRIL 1, 2025

Popular use cases include request for payments using the instant payment rails (above), loan payments and transaction verification to prevent fraud. Better Analytics: RCS provides detailed analytics on message delivery, read receipts, and customer interactions, enabling banks to optimize their communication strategies.

PYMNTS

FEBRUARY 26, 2020

fraud prevention firm Featurespace announced on Wednesday (Feb. Noting the worldwide cost of fraud is estimated at £3.89 trillion) Featurespace said as fraud techniques evolve so must prevention solutions. With the evolution of fraud , P2P payments and eCommerce are increasingly becoming key areas of cyberattacks.

PYMNTS

JULY 15, 2020

Mari Anne Bayliss , senior director of solution management at CyberSource , told Karen Webster that simply relying on machine learning as a weapon against fraud is not enough — not in an age where managing fraud risk during the great digital shift (and unprecedented transaction volumes) is so challenging. .

Perficient

FEBRUARY 12, 2025

Additionally, businesses should explore new revenue models through premium features and address integration complexities with robust data governance and analytics. Additionally, AIs capacity for real-time transaction monitoring and fraud prevention will help companies stay ahead of evolving regulatory demands.

PYMNTS

JULY 12, 2020

The Electronic Crimes Task Forces and Financial Crimes Task Forces will be merged into the Cyber Fraud Task Forces (CFTF). Secret Service has established a single agency to fight them, the Secret Service announced in a press release. Secret Service, in a statement.

Abrigo

JULY 13, 2023

Avoid fraud losses from pig butchering scams FinCrime professionals looking to prevent pig butchering scams in the age of cryptocurrency can follow these steps to tighten security. Takeaway 1 Investment fraud schemes known as pig butchering scams contributed to $3.3 billion in fraud losses in 2022. billion in 2021.

South State Correspondent

OCTOBER 16, 2024

Materials, training, and fraud also contribute to bank expenses. Increase Fraud Tools The largest impediment for customers using their card more often is the narrative espoused by many financial sites and advisors that the debit card is less safe than the credit card. Targeting dormancy is also a popular card marketing tactic.

PYMNTS

NOVEMBER 17, 2020

The number of real-time payments has risen dramatically in recent years, and APP fraud has grown alongside it. Bad actors typically perpetrate APP fraud in several ways. APP Fraud Ramps Up. Instances of APP fraud around the globe have continued to rise as real-time payment rails extend their reach.

PYMNTS

SEPTEMBER 20, 2019

19) that its Fleet module is now available to users of its artificial intelligence (AI) analytics platform that automates fleet card transaction analysis. The company said in an announcement on Thursday (Sept.

PYMNTS

DECEMBER 9, 2020

9) that it’s successfully completed its acquisition of GIACT and has expanded its suite of products for fraud prevention and identity verification. GIACT’s real-time payment analytics are a great addition to our existing strength in anti-money laundering and digital identity verification,” he said, according to the release. “We

Abrigo

SEPTEMBER 20, 2023

How financial institutions can prevent losses from 1st-party fraud Learn strong approaches to identifying, preventing, and detecting 1st-party fraud that will keep your AML program on top of fraud trends. Takeaway 3 Prevention and detection best practices can curb hard dollar 1st-party fraud losses while protecting clients.

PYMNTS

SEPTEMBER 24, 2018

Perhaps more troubling, however, is digital fraud’s projected future. Recently published research noted global fraud losses could top $6 billion by 2021, more than doubling the $3 billion lost worldwide in 2015. As such, businesses are now investing in their security and fraud prevention technology and solutions. All told, U.S.

PYMNTS

DECEMBER 18, 2020

These growing revenue streams carry their own risks, however, not the least of which is their propensity to be targeted by fraud. The Fraud Threats Of 2020. Most customers bypass restaurants entirely when trying to perpetrate chargeback fraud , with 76 percent of cardholders going directly to their payment card issuers.

PYMNTS

JUNE 20, 2019

Retailers focused on combating fraud have credit cards in the cross-hairs of their efforts. But ramping up the war on card fraud can introduce a new risk to companies: false positives. This isn’t merely an issue for the B2C world, however. The False Positive Threat.

PYMNTS

APRIL 15, 2020

While there is no shortage of new things in the world to get used to these days, cybercrime and fraud are, unfortunately, not among them. The good news, both Srinivasan and Awad told PYMNTS, is that while fraud attempts are up among U.S. consumers, fraud losses are not, yet. million pounds out of the unwitting. “We

Perficient

OCTOBER 24, 2024

The economic risks of AI to the financial systems include everything from the potential for consumer and institutional fraud to algorithmic discrimination and AI-enabled cybersecurity risks.

PYMNTS

MAY 4, 2020

Advances in technology are making consumer transactions seemingly more secure, but cybercriminals are still finding sophisticated ways to beat systems and commit financial fraud. A 2018 study on payment fraud mitigation reported that 75 percent of financial institutions (FIs) experienced fraud losses.

PYMNTS

MAY 1, 2020

Amid rising criticism over the loan effort, the Department Of Justice has reportedly discovered potential fraud among companies seeking relief with the Paycheck Protection Program (PPP). That team has been utilizing data analytics for over 10 years to find criminal activities linked to Medicare in addition to other federal programs.

Abrigo

JULY 10, 2020

Community banks and credit unions partnered with their communities to help families and businesses through these unprecedented times , causing spikes in consumer fraud that must be faced head on. According to the new advisory , t wo fraud typologies are trending: imposter scams and money mule schemes. Learn more. Learn More.

PYMNTS

AUGUST 13, 2020

Barclaycard has rolled out its Barclaycard Payment Intelligence (BPI) offering that harnesses detailed information analytics to give procurement departments a wide view of their supply chains, which allows them to save money, according to an announcement.

PYMNTS

MAY 5, 2020

“Credit unions across the country are on high alert for scammers looking to take advantage of members during the pandemic and are stepping up fraud prevention efforts as a result,” according to PYMNTS’ April Credit Union Tracker® done in collaboration with PSCU. This, in turn, helps mitigate fraud.”.

PYMNTS

NOVEMBER 3, 2017

It was a busy time for B2B venture capital this week, and while funding ranged across verticals from expense management to SaaS, there was a clear theme in investment rounds: high-tech data analytics. Expense Management. Glint plans to use the investment to scale operations and accelerate growth into Europe.

PYMNTS

JANUARY 14, 2021

Location, Location, Location: How Location Data Can Help Banks Prevent Online Fraud , a study by PYMNTS and GeoGuard , found that 55 percent of U.S. Customer communication, education and assured security are the keys to unlocking geocoding’s valuable analytics and ability to capture market share. Gaining Consumer Trust.

PYMNTS

JANUARY 8, 2021

Equifax has inked a deal to purchase artificial intelligence (AI)-powered fraud prevention and digital identity technology provider Kount for $640 million. As digital migration accelerates, managing authentication and online fraud while optimizing the consumer's experience has become one of our customers' top challenges,” Equifax CEO Mark W.

PYMNTS

SEPTEMBER 21, 2020

Consumers are using mobile apps’ order-ahead features and loyalty perks more often during the COVID-19 pandemic, yet chargeback fraud — also known as friendly fraud — is unfortunately also rising. A Proactive Approach To Friendly Fraud. Friendly fraud often develops around online promotions at restaurants.

Abrigo

FEBRUARY 12, 2025

Financial institutions have embraced advances in data-driven decision-making , using them to improve credit assessment, fraud prevention, and financial inclusion. These models influenced marketing strategies, collections, and fraud detection tools.

PYMNTS

DECEMBER 17, 2020

Fraud protection specialist Kount and Philadelphia-based payments platform FreedomPay are teaming up to offer “an integrated, complete solution to enable international expansion with fraud-free payments and frictionless customer” experiences.

PYMNTS

JUNE 22, 2020

It’s the battle against fraud that can be lost right at the beginning. There’s increased urgency on the part of financial institutions (FIs) to spend more time and money on battling fraud at the point of onboarding, especially as card-not-present transactions surge in the lingering wake of the coronavirus. alone topped $10.2

PYMNTS

SEPTEMBER 24, 2020

Fraud Threats To Digital Banking. Another threat is identity fraud, in which bad actors will either steal an individual’s identity or forge a new one, and then use it to open new accounts or apply for fraudulent loans they have no intention of paying back. Identity fraud accounted for $16.9

PYMNTS

NOVEMBER 17, 2020

But, as three banking security experts told Karen Webster, that same trillion-dollar loss represents a significant authentication opportunity for financial institutions (FIs) if they leverage risk-based authentication and behavioral analytics to help shape and safeguard the great digital shift. Deputizing The Consumer.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content