Crafting an effective CECL Q factor framework for stronger risk management

Abrigo

OCTOBER 9, 2024

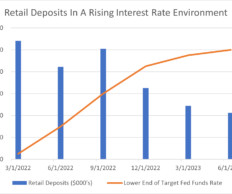

Learn best practices to adjust for risk. Would you like other articles on CECL and Q Factors in your inbox? This is where Q factors become essential, offering a way to adjust for future uncertainties, management's insights, and external factors such as regulatory changes or local economic shifts.

Let's personalize your content