Why PPP fraud hit fintechs harder than banks

American Banker

NOVEMBER 11, 2020

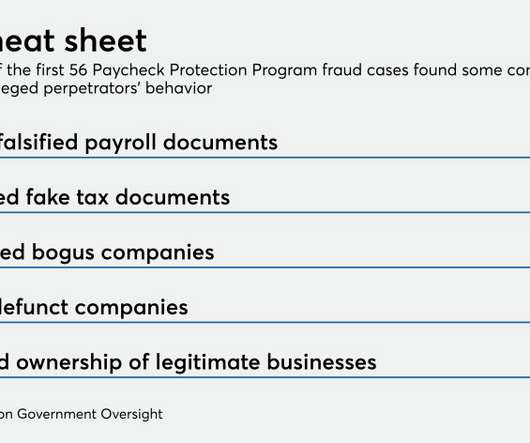

Scammers may have had more success at duping fintechs than banks in obtaining Paycheck Protection Program loans. But there are reasons for this apparent disparity.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

American Banker

NOVEMBER 11, 2020

Scammers may have had more success at duping fintechs than banks in obtaining Paycheck Protection Program loans. But there are reasons for this apparent disparity.

Banking 2020

NOVEMBER 24, 2015

First the good news – banks in Britain stopped nearly £1 billion in attempted fraud in the first six months of 2015. Banks prevented £7 in every £10 of attempted fraud, according to Financial Fraud Action (FFA) UK, which reports that losses on payment cards, online and telephone banking and cheques totalled £325.3

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

MAY 16, 2016

While Lending Club generally focuses its services on consumers, the implications of Laplanche’s resignation have echoed throughout the SME lending space as well and could see a further decline in banks backing small business loans offered through marketplace platforms. 65% of U.K.

Banking 2020

OCTOBER 9, 2015

Cases of card not present (CNP) fraud are continuing to rise across all corners of the globe, as EMV forces criminals away from traditional fraud channels. cents the year previously, and significantly higher than the less than one cent per $1,000 registered for cheque fraud. How can CNP fraud be prevented?

Banking 2020

SEPTEMBER 15, 2015

In the UK, the scheme was launched nearly seven years ago back in May 2008, and in the years following there was a surge in online banking fraud. After receding, online banking fraud losses jumped again last year to reach more than £60 million. Losses went from £22.6 million in 2007 to £52.2m in 2008 and £59.7 Prevention.

Banking 2020

OCTOBER 14, 2015

Social network analysis for fraud detection is becoming an increasingly important and useful tool. As payment fraud continues to rise, particularly in the card-not-present (CNP) space, this approach is proving an effective fraud detection technique. Traditional methods for detecting fraud involve a silo approach.

Banking 2020

JANUARY 29, 2016

Protecting a financial services organization against fraud requires much more than a strong password policy and client education. The sophistication of cyber attacks and high risk of fraud necessitate a comprehensive anti-fraud program that includes policies, processes and technologies. Step 2: Perform a root cause analysis.

Banking 2020

AUGUST 4, 2015

Often when we talk about card fraud we lump together credit and debit cards. Latest figures from the Federal Reserve in the US suggest something that perhaps we should already know – PIN debit cards suffer less fraud than signature credit cards. In the US, PIN debit cards saw a fraud rate of 0.89 transactions per 10,000.

Banking 2020

AUGUST 27, 2015

The US has been identified as the leading country for card fraud, after a new study revealed almost half of global losses to the crime last year occurred in the nation. In the US, fraud losses equated to 12.75c for every $100 spent in 2014. billion in 2020. This is according to The Nilson Report, which found 48.2

Banking 2020

DECEMBER 8, 2015

Mexico’s consumers are being hit by payment fraud losses, but they are prepared to do something about it. Fraud rises. In its latest country report on Mexico, The Paypers notes that consumers are exposed to fraud and are looking to their providers to tackle the problem. million cases of suspected fraud involving MXN 7.3

Banking 2020

MAY 29, 2015

Passwords are passé; biometrics is the future of banking: It may not be long before your bank or credit union of choice starts replacing passwords with biometric authentication options.

Banking 2020

DECEMBER 11, 2015

Ho, Ho, Hoax: According to ACI Worldwide, consumers need to brace themselves for a higher level of fraud online and across all channels this holiday season. With more consumers using devices to shop, fraud attempt rates increased by 30% compared to 2014.

American Banker

JULY 2, 2020

Axcess Financial is using stronger authentication, studying up on bad actors and planning to use a federal service that automates verification of Social Security numbers.

Banking 2020

OCTOBER 22, 2014

But amidst the reports of one data breach after another, check fraud has remained a constant thorn in the industry’s side, with 82% of U.S. retailers reporting being targeted, and banks suffering an estimated $650 million in losses from deposit account fraud, according to separate reports by AFP and the American Bankers’ Association.

Banking 2020

NOVEMBER 12, 2014

The business case for banks is straightforward. They also know the fraud cost of password hacks and the opportunity cost of low adoption of mobile services. They have excellent internal hard data on the high costs of password resets, lockouts and customers care calls for password problems.

Banking 2020

NOVEMBER 25, 2015

This has posed problems, not least the fact it’s the only country in the world where counterfeit card fraud losses are rising. Counterfeit card fraud to drop. In the UK, losses from domestic counterfeit card fraud fell straight away. Counterfeit fraud was cut by two-thirds in the years immediately after EMV rollout.

American Banker

NOVEMBER 4, 2020

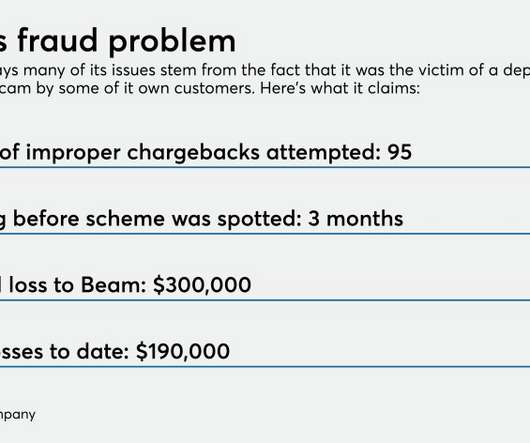

Some customer fraud and a lack of cooperation from partners Huntington Bank and Dwolla prevented Beam Financial from returning funds to savers, says Aaron Du, the fintech's CEO. He says he’s trying to make things right, but Huntington and Dwolla are taking the dispute to court.

American Banker

JUNE 15, 2020

Peoples Bank in Arkansas and Main Street Bank in Massachusetts are getting smarter about spotting suspicious transactions tied to unemployment benefit fraud as well as warning customers what to watch out for.

Banking 2020

NOVEMBER 17, 2015

It’s been very well documented that fraud tends to shift to the card-not-present (CNP) arena when EMV is introduced in a country. While there is some debate about just how much EMV will be the driver of CNP fraud in the US, it’s still expected to rise significantly over the coming years. Less face-to-face counterfeit fraud.

Banking 2020

DECEMBER 16, 2014

We see Apple Pay as a more modern, potentially more powerful tool in our efforts to reduce fraud, but EMV is already underway with issuers and merchants and will have a more immediate impact. How did this affect your attitudes as a business towards Apple Pay? We will be issuing EMV cards soon.

Banking 2020

NOVEMBER 28, 2015

Researchers have detailed one such case in France that they say is the “most sophisticated smart card fraud encountered to date”. These were card-present frauds that managed to nullify the PIN. The authors noted: “Until the deployment of CDA, this fraud was stopped using network-level counter-measures and PoS software updates.”

Banking 2020

NOVEMBER 18, 2015

Australia is toying with the idea of creating an opt-in function for contactless cards, in a move that highlights the problems around coping with new payment technology and how fraud risks are handled. The major banks provide a Zero Liability Policy to customers who are victims of fraudulent transactions. Legal constraints.

Banking 2020

AUGUST 11, 2015

It might sound like the most obvious piece of advice but it’s remarkable how much fraud takes place because people are lax with their PIN. Malware is a growing problem as more and more of your banking goes online. Figures from Financial Fraud Action UK show online banking fraud hit 32.35 million dollars (£29.3

Banking 2020

SEPTEMBER 10, 2015

According to the Federal Trade Commission, only 26 percent of stolen identities are used for credit fraud. Hackers steal your customers’ identities for a variety of reasons: utility fraud, employment fraud, etc. Do your customers know about these other types of fraud?

Javelin Strategy & Research

FEBRUARY 1, 2022

2022 Cyber-Trust in Banking Scorecard Javelin Report Date: September 27, 2022 Authors: Suzanne Sando , Alexander Franks Research Topic(s): Cybersecurity , Fraud & Security For consumers to trust their financial institutions, their expectations need to be met and exceeded. Bank of America ranked as “Best in Class” over 20 top U.S.

Banking 2020

OCTOBER 12, 2015

The key benefit of EMV is to reduce fraud from counterfeit, lost and stolen cards. After EMV chip-and-PIN cards were widely adopted in the UK in 2004, counterfeit fraud declined by more than 63 per cent in the ensuing years. EMV cards are not a silver bullet for card fraud.

Banking 2020

JUNE 11, 2015

PIN authentication is the most effective approach to maximize fraud protection, however, the authentication method is up to the credit card issuing bank. However, fraud prevention comes at a price. However, for card-present businesses that choose not to support EMV, the incident rate for fraud increased.

Banking 2020

NOVEMBER 19, 2015

While it’s unclear what sort of fraud could be committed, the financial services industry is taking note of the theft. Two clear avenues of potential fraud are opened up with biometric theft of this sort. Second, arguably more worryingly, is the prospect of mass first party fraud. million individuals.

Banking 2020

NOVEMBER 8, 2015

Clearly MasterCard is banking on consumers not being put off by the prospect of authenticating a contactless transaction. In terms of fraud, there is a strong case for contactless transactions even with a layer or two of extra processes like inputting a PIN. Fraud question.

Banking 2020

OCTOBER 16, 2014

Contributor, James W.

Banking 2020

SEPTEMBER 28, 2015

The key shift resulting from EMV will be a reduction in card-present fraud. Given the volume of fraud in the U.S., until 2020. Chip cards are being issued to consumers and merchants are upgrading their point of sale terminals to adapt. Or are they? Given the advantages of EMV cards, we would expect more enthusiasm.

Banking 2020

NOVEMBER 19, 2015

Three’s a crowd, so the saying goes, but it could also mean fraud losses for banks and merchants if they’re not careful. Within PSD2 is the Access to Accounts’ (XS2A) rule, which forces banks to enable access to their customer accounts to third party apps. Third party payment provider security.

Banking 2020

AUGUST 27, 2015

One new approach that banks are exploring to mitigate this particular vector of fraud is the notion of using smartphones as a second factor of authentication since most people always have their phone with them. According to a recent article in ATMMarketplace.com, card skimming accounted for more than $2 billion in losses.

Banking 2020

JANUARY 22, 2016

VCCU felt it was important to participate in any county-wide action that allowed us to help mitigate/thwart fraud attempts in our community. What feedback has Ventura County Credit Union received from this initiative?

Banking 2020

NOVEMBER 25, 2015

Until now, this sector has been subject to very little legislation, but there have been claims that this hands-off approach has helped facilitate problems such as fraud and money laundering. China has introduced new draft rules that are intended to tighten regulations governing online payments in the country.

Banking 2020

NOVEMBER 12, 2015

As more fraud takes place in the card-not-present sphere, card issuers are under growing pressure to improve security and biometric technology is seen as central to these efforts. Selfie Pay is not only an alternative to a PIN-based physical transaction in store or at an ATM, but also for online payments.

Banking 2020

NOVEMBER 8, 2015

XS2A means banks have to build an API structure that any company registered with a ‘competent authority’ can use to provide services, so long as the customer consents. The Finextra study found that 88 per cent of bank respondents believe that data protection and risk to reputation are significant issues.

Banking 2020

MAY 5, 2015

Ideally, they should make it easier for the customer to manage his or her money, while also building loyalty to the bank — and reducing costs or increasing revenue. Offering credit monitoring to customers allows them to stay in control of their credit profile, while also preventing bank losses.

Banking 2020

FEBRUARY 25, 2015

One note of caution here: Senior fraud already accounts for $2.9 Unlike those that came after, this demographic is perceived to be more loyal. They also have more disposable income, spend more online and could benefit more from technology assistance. billion in losses each year.

Banking 2020

JANUARY 25, 2016

There is always a weak link, so layers of security featuring encryption and tokenisation will continue to play a key part in the mix – as well as fraud detection systems that can analyse a transaction to establish if it is likely to be genuine.

Banking 2020

JANUARY 22, 2016

It’s early days but perhaps more needs to be done to educate and inform consumers about the benefits of EMV over mag stripe cards – particularly the security and fraud implications. One-third who had tried to use their new EMV card were not aware of the correct way to do so.

Banking 2020

SEPTEMBER 14, 2015

Losing your phone is bad enough without identity fraud on top of it. Smartphone theft is rampant, and leaving your phone unlocked makes it far too easy for thieves to gain access to your sensitive information.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content