U.S. Bank ties expense report management to virtual cards

Payments Source

SEPTEMBER 22, 2020

The bank worked with TravelBank, a fintech, to offer virtual cards and an app that automatically generates expense reports.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Source

SEPTEMBER 22, 2020

The bank worked with TravelBank, a fintech, to offer virtual cards and an app that automatically generates expense reports.

MyBankTracker

NOVEMBER 19, 2020

Online & Mobile Banking. Since there are no physical branches, digital banking tools are crucial to helping customers access and manage their CIT Bank accounts. And, they should be more than enough to handle the majority of everyday banking transactions. How to Find Your Bank’s Routing Number.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Banking 2020

DECEMBER 15, 2014

Millennials, generally defined as the demographic cohort born between 1982 and the early 2000s, will account for half of the American workforce by 2020. Here’s a look at why and how managers should adjust their style to effectively lead the new generation of workers. Voices advice management millennials work' Be transparent.

BankUnderground

FEBRUARY 7, 2025

Benjamin Kingsmore Central banks do a lot of things: they implement monetary policy, regulate financial institutions, manage payment systems and analyse economic developments. And to make all this happen in practice, armies of unseen officials do the necessary implementing, regulating, managing and analysing.

Payments Source

SEPTEMBER 22, 2020

City National Bank CEO Kelly Coffey talks about what she’s doing to create a more transparent and supportive workplace, as well as the challenges of expanding during a pandemic.

American Banker

SEPTEMBER 17, 2020

Small and midsize banks would pay for access to the Monit app and offer it to small-business clients as an add-on service.

Gonzobanker

MARCH 26, 2020

According to the Cornerstone Performance Report for Banks , the median bank’s active mobile banking users as a percentage of checking accounts was 36% in 2019, digital origination of consumer loans stood at 12% of volume, and deposit accounts originated online were an anemic 2%. Get Gritty on Digital Servicing.

American Banker

SEPTEMBER 22, 2020

The bank worked with TravelBank, a fintech, to offer virtual cards and an app that automatically generates expense reports.

PYMNTS

MAY 16, 2016

While Lending Club generally focuses its services on consumers, the implications of Laplanche’s resignation have echoed throughout the SME lending space as well and could see a further decline in banks backing small business loans offered through marketplace platforms. 65% of U.K. and U.S.

American Banker

OCTOBER 13, 2020

Mobile and online banking technologies that the Toronto bank previously rolled out, including a virtual assistant developed by Kasisto and money management tools made by Moven, have become much more popular since the arrival of COVID-19.

American Banker

OCTOBER 15, 2020

Bank of America is applying a familiar arsenal — including APIs and its popular virtual assistant, Erica — to online business banking, cross-border payments and cash management in an effort to modernize those services.

American Banker

NOVEMBER 19, 2020

The company's new relationship with Billshark highlights its quest for partners that can deliver financial management products to complement its banking services.

American Banker

JULY 23, 2020

are offering banks to help borrowers manage their monthly payments. Finding loan forgiveness programs and keep-the-change loan paydowns are examples of services startups like Savi, Summer and FutureFuel.io

American Banker

AUGUST 31, 2020

Caitlin Long, a former Morgan Stanley and Credit Suisse managing director, is starting a special-purpose depository institution that will provide payment and custody services to institutional investors and corporate treasurers.

Payments Source

JUNE 11, 2020

The company is partnering with Sensibill, a fintech whose technology turns photos of receipts into text and helps people track and manage their expenses.

American Banker

JULY 8, 2020

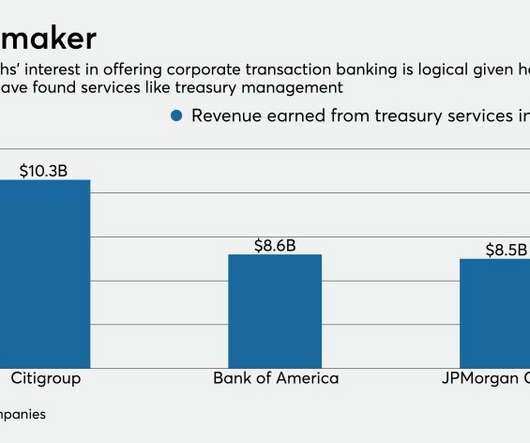

banks, betting that superior technology can lure companies with complex cash-management needs. The Wall Street firm is jumping into a market dominated by a handful of big U.S.

American Banker

JUNE 19, 2020

With money flow suddenly stifled for millions of customers, demand for money management tools has skyrocketed.

Banking 2020

OCTOBER 23, 2014

Interim management services. While relocating resources and long-term outsourcing proves to be beneficial to smaller organizations, it’s important to note that temporary management solutions also yield much value. There has been an increase in the use of interim management services in the financial sector in recent years.

Banking 2020

OCTOBER 30, 2014

A bank must have zero tolerance for website downtime as it impacts your clients’ ability to access their money. The actual launch date of the website was a little later than what we anticipated because we wanted to ensure that it was working flawlessly at launch.

Banking 2020

NOVEMBER 24, 2014

Animation aside, that would probably be Moneyball , an absorbing analysis of the moves made by Oakland As manager Billy Beane to rely more on technology-driven data than old-school scouting to put together his 2002 roster. Anybody remember the last time Brad Pitt showed up in a big-screen movie that didn’t have much blood and gore?

Banking 2020

SEPTEMBER 18, 2014

As a financial institution, guiding your clients through personal finance, money management, and budgeting goals can help you stand out. Client services are an integral part of any business.

American Banker

JUNE 11, 2020

The company is partnering with the fintech company Sensibill, whose technology turns photos of receipts into text and helps people track and manage their expenses.

Banking 2020

DECEMBER 18, 2014

We’re in the business of handling other people’s money, and the constant battering we get for failing to manage our own helps no one. There surely is, and it has to do with the fact that our industry cannot, and should not, have to ask for more government assistance, even if it’s permitted under the law.

Banking 2020

DECEMBER 16, 2014

To get a better sense of what adopting Apple Pay actually looks like, we chatted with Brice Mindrum, mobile services manager for America First Credit Union. You can see the full list of participating issuers here. Banking.com: Now that you’ve been offering Apple Pay to customers for a few days, are you seeing a rapid adoption?

Banking 2020

NOVEMBER 4, 2014

Just as a bank teller speaks differently to a client than to a colleague, tone and content of communication will be different for a management report and those prepared specifically for the Board of Directors. Elliott Welton, Sageworks. Voices board carrer presentation'

Banking 2020

NOVEMBER 25, 2014

I recently spoke to a financial management company who had a partnership with a collection agency. The partnership allowed the financial management company’s users to call the collector to negotiate a settlement.

Banking 2020

MARCH 24, 2015

For over a decade, Financial Literacy Month has been backed by many organizations including the National Foundation for Credit Counseling , Money Management International , and the United States Congress, among others. The overarching goal of Financial Literacy Month is to educate consumers on managing their money effectively.

American Banker

JUNE 26, 2020

Citizens Bank and Citigroup are among the financial institutions plugging away at a service that has gained little traction among customers.

Banking 2020

DECEMBER 16, 2014

A big part of this is moving from reactive to proactive talent management. Take Smart Risks: Managers generally hire people who walk and talk like everyone else on the team. Obvious examples include functions like technology, data, security, finance; and business groups like payments, fintech and retail banking.

Banking 2020

JANUARY 27, 2015

Global transaction banking business will need a strong push to support multiple revenue streams, agile- operating technology and product management models. The move is towards corporates generating more cash internally through automation and process efficiencies than relying on borrowing funds from banks. Concluding Thoughts.

Banking 2020

DECEMBER 4, 2014

They instead seem to be launched and micro-managed by a small group of individuals who are intimately familiar with the inner workings of the industries and corporations they attack. The perpetrators don’t just use flawless English, they seem very comfortable with the industry parlance used by the businesses they target.

Banking 2020

NOVEMBER 12, 2015

These tokens can be single- or multi-use; and they may be stored and managed in the cloud, in a token vault, or at a merchant location. In tokenization, the card’s primary account number (PAN) is replaced with an alternate card number called a token. Tokenization confusion.

Banking 2020

MAY 5, 2015

Beyond the Checking Account: What Customers Want From Their Banks. The best add-on services are those that are mutually rewarding to both the customer and the bank. Ideally, they should make it easier for the customer to manage his or her money, while also building loyalty to the bank — and reducing costs or increasing revenue.

Banking 2020

JUNE 23, 2015

Marshall Yuan is a senior product manager at Digital Insight Labs where he has been leading experimentation in new solutions to help financial institutions engage and delight their end users. Additionally, Marshall previously served as product manager for Digital Insight’s Android application and personal finance management products.

Javelin Strategy & Research

FEBRUARY 1, 2022

Bank of America ranked as “Best in Class” over 20 top U.S. 2020 Mobile Banking Scorecard: COVID-19 Affirms Smart Updates and Glaring Gaps Javelin Report Date: July 1, 2020 Authors: Emmett Higdon Research Topic(s): Digital Banking , Mobile & Online Banking Javelin’s 14th annual Mobile Banking Scorecard evaluates 25 of the top U.S.

American Banker

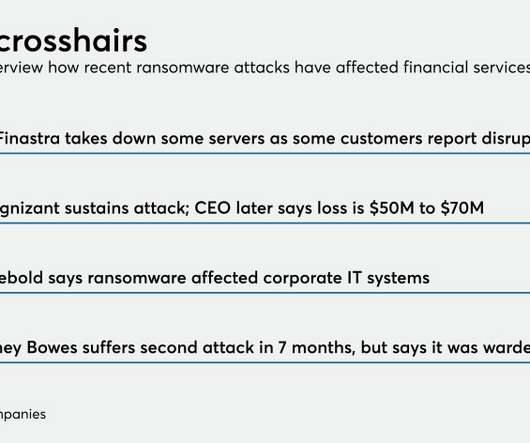

MAY 26, 2020

Here’s how banks can guard against that. Cybercriminals have targeted at least four financial services technology companies in recent months, potentially giving hackers back-door access to clients.

Banking 2020

MAY 27, 2015

Cloud-based accounting systems can be accessed on your mobile device to ensure that you remain timely in managing important financial tasks like payroll and tax obligations, but you must take precautions to keep your business data secure. Don’t assume that your mobile browser is secure. Treat your mobile device like a computer.

Banking 2020

JANUARY 8, 2015

Data-driven buy-hold-sell management helps companies weed out unnecessary assets and focus on what furthers the business. As companies identify and eliminate valueless IT assets through buy-hold-sell management, the IT operating model becomes focused, lean and more efficient. Think like a stockbroker. Agility of the Lean.

Banking 2020

DECEMBER 4, 2014

They instead seem to be launched and micro-managed by a small group of individuals who are intimately familiar with the inner workings of the industries and corporations they attack. The perpetrators don’t just use flawless English, they seem very comfortable with the industry parlance used by the businesses they target.

Banking 2020

JUNE 19, 2015

Moving from financial literacy: Only 58% of college students reported they felt prepared to manage money while in college. Articles via CircleID, Huffington Post, Biometric Update.Bank launches with a bang: General availability for.bank starts on June 23 rd and it looks like there is already high interest in the domain name.

Tech and Finance

APRIL 29, 2016

PWC Retail banking. In its report on Retail Banking 2020 — Evolution or Revolution, PWC optimistically ignores many of the details of its survey and concludes that banking has a great days ahead. Banks need to decide whether they want to shape the industry, become fast followers or manage defensively, the report added.

Tech and Finance

APRIL 29, 2016

PWC Retail banking. In its report on Retail Banking 2020 — Evolution or Revolution, PWC optimistically ignores many of the details of its survey and concludes that banking has a great days ahead. Banks need to decide whether they want to shape the industry, become fast followers or manage defensively, the report added.

Banking 2020

DECEMBER 11, 2015

Mobile apps: the next big thing in supply chain automation: Due to the simplicity of using mobile apps on a smartphone, they are now becoming ideal for operational supply chain management activities. Enterprises are considering them as the go-to software for inter-connecting all essential components of the supply chain.

Banking 2020

NOVEMBER 24, 2014

Animation aside, that would probably be Moneyball , an absorbing analysis of the moves made by Oakland As manager Billy Beane to rely more on technology-driven data than old-school scouting to put together his 2002 roster. Anybody remember the last time Brad Pitt showed up in a big-screen movie that didn’t have much blood and gore?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content