Big Data Explosion

Cisco

APRIL 26, 2022

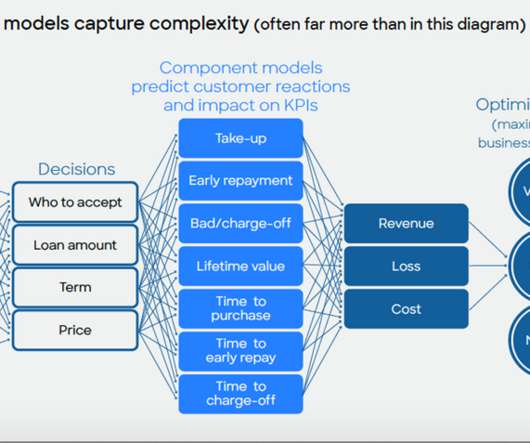

This challenge is compounded by the growing use of alternative data from sources like customer data platform (CDP) providers, fintech partnerships, and even from sensors and IoT devices. This momentum is also being fueled by growing adoption of cloud-native fintech solutions that are built on these capabilities.

Let's personalize your content