Triggering (Actionable) Big Data Insight, Always In Motion

PYMNTS

MARCH 7, 2018

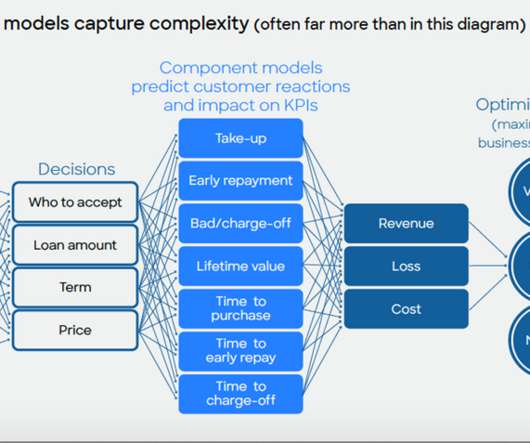

We humans can’t respond to the immense amount of information that is being collected in real time, but by using Big Data analytics of data in motion, as it’s being created, this information can immediately become actionable. Big Data projects can be production-ready in as little as 60 days, he said.

Let's personalize your content