A new era of technology enabled financial risk management (Part 1)

Insights on Business

JUNE 18, 2019

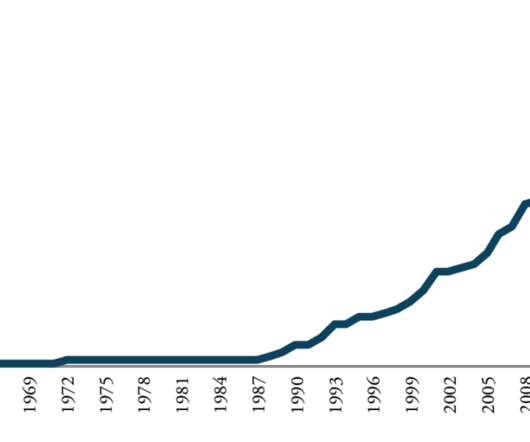

In this series of blogs, we will focus on four transformative technologies with emerging risk applications that can help banks and financial institutions grow profitability and protect the enterprise. Each technology is at the start of an enormous adoption growth curve, and has been the subject of intense discussion.

Let's personalize your content