Fiserv, Capital One, others invest $150M in Melio

Payments Dive

NOVEMBER 4, 2024

Some of the corporate investors are also partnering with the accounts payable and receivable company they’re backing.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

NOVEMBER 4, 2024

Some of the corporate investors are also partnering with the accounts payable and receivable company they’re backing.

Accenture

SEPTEMBER 23, 2020

The COVID-19 pandemic has had a significant impact on the banking and capital markets (B&CM) industry as liquidity, rates and fees continue to be stressed and regulatory and business-driven demands evolve rapidly. The post COVID-19’s impact on banking and capital markets appeared first on Accenture Banking Blog.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 10, 2024

The three companies announced last Wednesday that they are teaming up to launch a free service intended to combat fraud and reduce the amount of transactions that are improperly declined.

PYMNTS

AUGUST 14, 2020

Initialized Capital Management has notched $230 million for Initialized V , the California venture firm’s fifth fund, which is geared toward backing early-stage companies, Bloomberg reported. Initialized Capital Management Co-Founder Garry Tan told Bloomberg, “We love finding tomorrow’s unicorns.”. million in a Series A round.

Perficient

SEPTEMBER 15, 2021

Section 165(a) of the Dodd-Frank Act requires the Federal Reserve to establish “enhanced supervision and prudential standards” for bank holding companies with more than $50 billion assets. This scrutiny level is stronger than the standards applicable to smaller institutions and increases based on a bank holding company’s unique riskiness.

PYMNTS

JANUARY 21, 2021

And enter Drip Capital , the middleman that serves as the financial grease that enables trade to flow, easing concerns of both buyers and suppliers. said Pushkar Mukewar , co-founder and CEO of Drip Capital in a conversation with PYMNTS’ Karen Webster. While the company is currently doing business in the U.S.,

PYMNTS

SEPTEMBER 7, 2020

Despite the pandemic, venture capital dollars are flowing freely to nascent firms in Asia that are tackling the need for contactless interactions and platforms that match supply and demand — setting the stage for innovation on the other side of the public health crisis. Traditional companies have had to embrace tech at an accelerating pace.

Perficient

OCTOBER 27, 2022

Further, large banking organizations that are not GSIBs generally are not subject to TLAC or long-term debt requirements, clean holding company requirements, rules related to qualified financial contract stay provisions in resolution, or Board guidance on recovery planning. Current Capital Requirements. of total leverage exposure.

South State Correspondent

NOVEMBER 15, 2022

the As interest rates go back up and volatility continues to remain high, banks’ cost of capital has undergone a significant shift up. Your cost of capital is essential to know for several reasons. Produce over your cost, and you will be able to attract more capital. Why Calculate Your Cost of Capital?

Payments Dive

MAY 2, 2023

The company that provides community banks with payments, fintech and other services is gunning for growth with new private equity capital.

Payments Dive

JULY 17, 2024

The student loan sale is the latest loose end Discover seeks to tie up since Capital One announced its intent to purchase the card company.

Bank Innovation

JANUARY 29, 2020

With nearly 200 startups, five major banks, 19 venture capital firms and representation from large tech companies like Google, Facebook, PayPal, Toronto is quickly becoming a center for fintech entrepreneurship.

Perficient

MARCH 22, 2023

Recent headlines have highlighted the failure of SVB Financial Group, the parent company of Silicon Valley Bank (“SVB”). Short Capital? SVB Financial had Tier 1 risk-based capital of 15.40% as of December 31, 2022, over 80% higher than the 8.50% regulatory required ratio. Total risk-based capital 16.18 Tier 1 leverage 8.11

Chris Skinner

SEPTEMBER 26, 2018

However, if you want to get an idea, a new survey from Moorlands Human Capital, an executive recruitment search and consulting company, has a view. That’s because they asked 500 FinTech companies how much they pay the CEO? Good question, and it all depends on the revenue forecast. appeared first on Chris Skinner's blog.

PYMNTS

NOVEMBER 20, 2020

Chipper CEO Ham Serunjogi confirmed on Twitter the startup, which got its initial foothold in the market as a peer-to-peer (P2P) payments service, has just wrapped up a $30 million Series B round of venture capital. Ribbit Capital, a VC firm in the U.S. that focuses on early-stage firms, led the investment round. Stripe, the U.S.-based

PYMNTS

JUNE 26, 2020

Small business lending emerged as a common theme in this week’s B2B venture capital roundup, and it’s no surprise, considering the role small and medium-sized businesses (SMBs) play in supporting their local economies. Utility account aggregation company Urjanet secured $14.65 Aye Finance.

Perficient

MAY 26, 2021

In the session “Differentiating Your Brand for the Digital Era,” Scott will discuss how financial services companies can leverage digital technologies in new and innovative ways to create new value for consumers and businesses. The presentation will occur on June 10 at 4:00 p.m.

Perficient

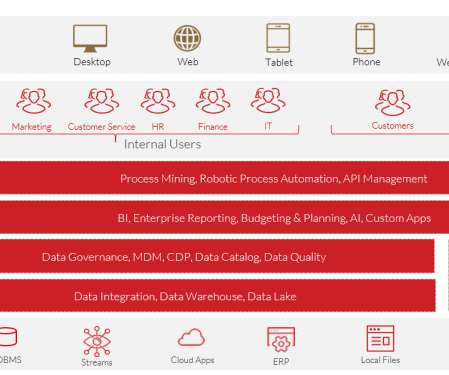

AUGUST 23, 2021

Increasingly, customers engage with companies that demonstrate authentic knowledge of their relationship – and this requires data. Over the next three years, we expect that 75% of financial service segments will shift from piloting to operationalizing AI/ML. Analysts predict that there will be 175 zettabytes (that’s one trillion gigabytes!)

PYMNTS

NOVEMBER 19, 2020

Venture capital cash has been flowing this year to companies that plan to buy up sellers on Amazon and help them grow. million in venture capital this month; FBA Heroes , which netted a $65 million seed round, also this month; and Thrasio , which announced it had raised $260 million in July.

PYMNTS

NOVEMBER 24, 2020

Digital auto insurer Metromile plans to go public by merging with publicly traded INSU II (Nasdaq: INAQ), a special purpose acquisition entity sponsored by Cohen & Company (NYSE: COHN). The combined company, to be led by Metromile CEO Dan Preston , will have a pro forma market capitalization of approximately $1.3

Payments Dive

JUNE 3, 2022

Josh Whipple, a former investment banker, is taking the top finance job as the company gears up for more acquisitions to capitalize on a drop in valuations.

PYMNTS

SEPTEMBER 29, 2020

Stripe led the round, and existing investors Y Combinator and Global Founders Capital participated, alongside a new investor, Bedrock Capital. The company launched in 2019 and had a seed round then for $2.7 Filipino online payments platform PayMongo has come off a funding round with $12 million, according to a press release.

PYMNTS

AUGUST 21, 2020

Historically, wealthy citizens have gotten around this through foreign investments in real estate and other assets, sometimes even using shell companies to carry out investments,” the survey said. It’s highly unlikely that all of this is capital flight,” Chainalysis said in the report.

Perficient

MARCH 19, 2021

The largest program announced, dollar-wise, by the Treasury Department was the creation and funding of the Emergency Capital Investment Program (ECIP). Program funding will provide a combination of grant capital and technical assistance that target communities impacted by the COVID-19 pandemic.

PYMNTS

OCTOBER 16, 2020

billion in venture capital investments between January and September 2020, according to a press release from London & Partners emailed to PYMNTS. Global investments are below the levels of pre-pandemic days, but London FinTechs have surpassed their 2018 venture capital totals of $2.3 billion in investments.

PYMNTS

NOVEMBER 24, 2020

Meanwhile, Australia’s West Coast Aquaculture (WCA) completed an initial public offering that raised the company $3.65 FinTech STAX, a capital-raising platform that accepts both dollars and cryptocurrency, helped WCA raise the funds. “We We hope this bold initiative helps open the door to more global investment for local companies.”.

PYMNTS

DECEMBER 18, 2020

Chinese companies held 30 initial public offerings (IPOs) this year, raising $11.7 The IPO rate for Chinese companies is the highest since Alibaba’s massive market debut in 2014, according to CNBC , citing a new report from Renaissance Capital. market for 2020, according to Renaissance Capital. stock exchanges.

PYMNTS

DECEMBER 18, 2020

Digital trust-and-safety company Sift said that 2020 has been a “banner year” for online shopping sales, but that scammers have modified their approaches to take advantage of the boom, according to an announcement.

PYMNTS

JANUARY 7, 2021

Current investors Bessemer Venture Partners, Runa Capital and Acton Capital Partners also took part. billion ($2 billion), the company said in a press release. TCV's investments include Netflix, RELEX, Spotify and WorldRemit. . The deal raises the valuation of Mambu and its software banking platform to more than €1.7

Payments Dive

NOVEMBER 9, 2022

The digital payments company is aiming to cut costs by streamlining operations, reducing capital expenditures and pulling back on vendor contracts.

Payments Dive

SEPTEMBER 16, 2022

The company, which aims to simplify freight shipment payments, plans to use $26 million in new capital and $100 million in debt financing to scale and give customers access to working capital.

PYMNTS

OCTOBER 12, 2020

Just months after a fundraising round that left the company's value at $3.5 A spokeswoman for the company said there “are not yet any concrete plans for another funding round at this present moment.”. N26 already has raised nearly $800 million in venture capital, Bloomberg reported, including a $100 million round in May 2020.

South State Correspondent

JULY 25, 2020

Companies gained confidence at the end of the second quarter and started to lease more space. In this article, we take a quick look at national CRE industrial sector economics and explain why banks may want to consider reallocating more capital to this area. .

PYMNTS

OCTOBER 8, 2020

“With a line of credit from Ripple, your financial institution can use XRP to complete instant, low-cost cross-border transfers,” the company said in its announcement. “We The service “lowers both the cost of holding trapped capital and operational costs associated with sending cross-border payments,” Ripple wrote in the announcement.

PYMNTS

JUNE 29, 2020

Tencent and private equity heavyweight Primavera are spearheading the $300 million investment in Xingsheng Youxuan, Bloomberg reported , citing sources familiar with the deal, which values the company at a healthy $3 billion.

PYMNTS

AUGUST 21, 2020

While many firms returned the money at Citi’s request, the bank said in court documents, a dozen have been sued after what the bank called an “operational error” caused it to transfer $900 million of its own funds to Revlon creditors one day after the troubled cosmetics company was sued over its restructuring tactics. On Tuesday (Aug.

PYMNTS

SEPTEMBER 21, 2020

As a financing tool that requires business owners to place valuable assets — whether working capital or physical — up for collateral, asset-based financing (ABF) was often viewed as a solution to a dire problem when no other options were available.

Abrigo

NOVEMBER 13, 2024

Businesses' working capital cycles are longer. However, recent data from Abrigo shows that privately held companies across the U.S. Abrigo’s proprietary analysis comes from the largest real-time database of private-company financial statement information in the United States. Leveraged has improved since 2019. A recent U.S.

PYMNTS

NOVEMBER 20, 2020

Investors just delivered another $90 million into the coffers of Loadsmart , a digital freight startup, the company announced Friday (Nov. Chromo Capital co-led the deal. Also participating were Perry Capital, founded by Richard C. Also participating were Perry Capital, founded by Richard C.

PYMNTS

OCTOBER 2, 2020

Scan recent headlines and you’ll see that Equifax bought Ansonia Credit Data; Corsair Capital bought B2B payments solution provider MSTS, and OnDeck was bought out. Special purpose acquisition companies (SPACs) have been all the rage, too. And companies must deliver — or risk being rendered obsolete. to go public.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content