Corpay to acquire GPS Capital Markets

The Paypers

JUNE 20, 2024

US-based business payments provider Corpay has entered into a definitive agreement to acquire fintech company GPS Capital Markets.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Bank Innovation

MARCH 24, 2020

billion since its 2017 founding, is optimistic about venture capital funding for tech companies, despite current market volatility. Within our sector, we definitely may have a slowdown, but it’s not doomsday, where nobody […].

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Bank Innovation

JANUARY 23, 2019

Capital One Financial has reportedly acquired Walmart's card receivables, the bank's chairman and CEO, Richard Fairbank, said yesterday. Terms of the transaction were not disclosed.

Abrigo

FEBRUARY 1, 2023

This change in approach introduces new variables in the interest rate projections that for decades have been a non-issue as we were effectively in a 0% interest rate market. Markets move in unpredictable ways when least expected. This happens when market expectations are for a reduction in inflation or a flight to safety.

PYMNTS

JANUARY 23, 2019

Capital One ’s domestic card loans increased 8 percent in the fourth quarter of 2018 , the bank said on Tuesday (Jan. billion, a jump Capital One said was mainly due to a 65 percent increase in marketing expenses. Capital One takes over for Synchrony Financial , which had a nearly 20-year relationship with the retail chain.

PYMNTS

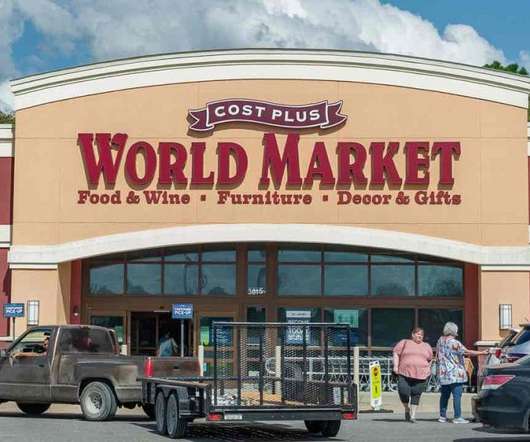

JANUARY 19, 2021

19) that it has finished its sale of Cost Plus World Market (CPWM) to California-based private equity firm Kingswood Capital Management, according to a statement. announced that it had entered into a definitive agreement to sell Cost Plus to Kingswood. Bed Bath & Beyond Inc. said on Tuesday (Jan.

BankBazaar

DECEMBER 19, 2023

In the previous article, we discussed two extremely important ways of ensuring a peaceful retirement life: National Pension Scheme (NPS) & Public Provident Fund (PPF) In this article, we will discuss two other ways of growing your savings: Share Markets and Mutual Funds. And stocks? They are the treasures you find under the water.

PYMNTS

JANUARY 19, 2021

In today’s top retail news, Bed Bath & Beyond said it has finished its sale of Cost Plus World Market (CPWM) to a private equity firm, while Starbucks will help Washington state with the distribution of coronavirus vaccines. Bed Bath & Beyond Finishes Sale Of Cost Plus World Market To PE Firm. Bed Bath & Beyond Inc.

CFPB Monitor

DECEMBER 22, 2020

The FDIC has issued a final rule that establishes a new framework for analyzing whether deposits made through deposit arrangements qualify as “brokered deposits” and amends the methodology for calculating the interest rate restrictions that apply to less than well capitalized insured depository institutions (IDIs).

PYMNTS

DECEMBER 14, 2020

has entered into a definitive deal to sell Cost Plus World Market to Kingswood Capital Management, while Authentic Brands is reportedly in discussions with Arcadia Group and Debenhams. Bed Bath & Beyond Strikes Deal To Sell Cost Plus World Market. In today’s top retail news, Bed Bath & Beyond Inc.

South State Correspondent

DECEMBER 5, 2023

Commercial bankers are trusted advisors and have a unique opportunity to understand their client’s specific financial and personal situations, explain the basic concepts of capital markets, and offer prudent and objective advice to help customers reach their goals.

PYMNTS

DECEMBER 16, 2016

Though many financial institutions recognize the opportunity to help middle-market businesses automate their AP payments, they have not been able to fully capitalize on the opportunity. Here the elusive payments opportunity meets or, in fact, doesn’t meet, the elusive audience: accounts payable automation for middle-market firms.

South State Correspondent

APRIL 11, 2024

The data indicates that, in all probability, you will most definitely get a question about capital management, mostly around buybacks, credit, reserves, and the economy, mostly around what the bank is seeing in their market. M&A, by contrast, is also near 99% for acquisitive banks but less than 30% for non-acquisitive banks.

South State Correspondent

FEBRUARY 27, 2024

Treating all credit facilities equally by setting minimum credit spreads regardless of size, term, cross-sell opportunities, lifetime value, and credit quality leads to misallocation of capital and substandard return on assets (ROA) and return on equity (ROE). Many banks target profitable commercial clients.

Jeff For Banks

FEBRUARY 12, 2024

3/25 Before we start, a summary of a quote by Einstein that perfectly captures the concepts being discussed; doing the exact same think and expecting a different result is the definition of insanity. Raised capital in late 2019. Entered Indianapolis on 5/2021, a top 2 Midwest market with Columbus, another market $CFBK is in.

PYMNTS

OCTOBER 21, 2020

The company said the new funding will “provide capital, as well as access to KKR’s operational resources and global network.” At RVshare, our mission is to expand the definition of travel,” said RVshare’s CEO Jon Gray. Jon and team have proven they can deliver explosive growth with impressive capital efficiency.”.

South State Correspondent

MARCH 5, 2024

First, larger loans are made to larger companies, and larger companies typically have more access to liquidity and capital, making them more credit-sound. These larger companies have already withstood the test of time and have survived business downturns, and the market has validated their business models.

South State Correspondent

MARCH 5, 2024

First, larger loans are made to larger companies, and larger companies typically have more access to liquidity and capital, making them more credit-sound. These larger companies have already withstood the test of time and have survived business downturns, and the market has validated their business models.

PYMNTS

JANUARY 31, 2019

. “After a decade of community bank consolidation, without a single new bank charter, we see a generational opportunity to bring true community banking — and unparalleled customer service — back to the Greater Washington region, arguably the best banking market in the nation,” stated Vision Bank, according to reports.

PYMNTS

NOVEMBER 12, 2020

The banking group has started reaching out to possible bidders, but still hasn’t made a definitive decision as to whether it will actually sell the unit, which specializes in store-branded credit cards, according to a Bloomberg report. Selling the private-label credit card unit would be a business reversal for the financial services group.

PYMNTS

OCTOBER 22, 2020

have struck “a definitive business combination agreement” that would turn the used-car behemoth into a public company. used-vehicle market is ripe for disruption with less than 1 percent e-commerce penetration.” The companies said that there are “significant market share expansion opportunities.”.

PYMNTS

AUGUST 14, 2019

In Australia, this blurred line between small business and consumer financial services became the focus of a recent SmartCompany report highlighting the challenge that small business owners face when seeking working capital. But that mix is not a smart tactic for managing company spend and finances.

PYMNTS

JULY 26, 2018

The letter also suggests clarity on whether the legislation’s interest deduction limitation is or is not considered a method of accounting, providing relief for SMBs that are “currently on improper accounting methods,” and clarity on the definition of “gross receipts” for purposes of qualifying as a small business.

BankBazaar

MAY 7, 2024

Strong bank partnerships have significantly bolstered BankBazaar’s position in the market. “ Our journey has been significantly strengthened by our existing partnerships, which have helped us consolidate our position in the market. 50 crore in two independent debt financing rounds led by Tata Capital and Nuvama Asset Management.

South State Correspondent

JULY 10, 2024

The lack of a data-driven pricing strategy is one major reason why most banks produce under their cost of capital. A pricing position is where you want to be in the market relative to your competition. Pricing position is closely related to your brand as it is an important signal to the market. The two are different.

PYMNTS

JULY 29, 2019

Reports said the firm is in discussions with various banks and non-bank financial companies (NBFCs) to introduce new working capital solutions for B2B vendors in India. Payoneer is also looking to introduce a merchant cash advance solution in the market to finance outstanding receivables for B2B sellers. “We We will do both.”.

PYMNTS

DECEMBER 19, 2017

18) said unnamed sources suggest Amazon is planning to invest in alternative lender Capital Float, based in India. According to The Economic Times , three unnamed sources confirmed the news, which separate reports in VCCircle said would likely be a top-up to the $45 million in Series C funding Capital Float raised earlier this year.

PYMNTS

AUGUST 10, 2020

Despite government initiatives to connect small businesses to capital as quickly as possible, the U.S.’s Even as small businesses are able to access capital, it’s often not enough to endure the ongoing market volatility and uncertainty. Traditional bank loans aren’t always easy to access, either.

PYMNTS

DECEMBER 10, 2018

The parking industry is a significant market but remains fragmented with many opportunities for technological innovation,” Michael Ronen, managing partner at SoftBank Investment Advisers, said in a press release.

PYMNTS

OCTOBER 16, 2020

Yandex regrets to confirm that it has not been able to agree to definitive transaction terms with the core shareholders of Tinkoff, and accordingly that the parties have mutually agreed to terminate discussions regarding a possible offer by Yandex for 100% of the share capital of Tinkoff,” Yandex said in a press release.

PYMNTS

SEPTEMBER 28, 2020

When an organization is bearing an ever-increasing burden of outstanding accounts receivables, there are multiple sources of capital to which it can turn. "It's been a really rough adjustment for a lot of them.". Yet they're not all created equal, James explained, and many sources lack a more humane approach to easing the burden of debt.

PYMNTS

OCTOBER 17, 2016

14) that it has entered into a definitive agreement to acquire PitchBook Data, Inc. PitchBook, founded in 2007, delivers data, research and technology covering the breadth of the private capital markets, including venture capital, private equity and mergers and acquisitions.

PYMNTS

OCTOBER 9, 2018

63 percent of small businesses applied for a working capital loan last year, data from S&P Global Market Intelligence recently found. “Transparency is key to standing out in the cluttered SMB market.” In the U.S., It’s on this business model that alternative finance in the U.K. In the U.S.,

PYMNTS

FEBRUARY 2, 2020

Customers using the app can also ask for funding to aid their working capital and equipment financing needs from their mobile devices. Those offerings include Money Market Savings and OneBusiness Interest Checking accounts. OneWest, for its part, provides a wide array of account features and products meant to help small businesses.

BankBazaar

APRIL 11, 2023

Adhil Shetty, Co-Founder and CEO, BankBazaar.com, says: “ We have a compelling growth story to tell at a time when reports suggest PE/VC investments nearly halved in February 2023 and that the funding winter will get worse before it gets better due to concerns about global recession and increased cost of capital.

Abrigo

JANUARY 11, 2022

Financial institution leaders and decision-makers constantly face choices for how to effectively manage their institutions in the wake of changing economic landscapes, investment markets, interest rates, customer demand, mergers, acquisitions, and more recently, pandemics. What are financial institutions trying to accomplish with ALM?

PYMNTS

AUGUST 4, 2020

But then ask him how the funding will change what his company does and how it goes to market and the enthusiasm spills out. “We And I think this funding will ensure that we take a very long-term view of the business and will allow us to be aggressive, because this is definitely eCommerce prime time.

South State Correspondent

APRIL 3, 2023

We made the case that, over time, the market does not adequately compensate banks for credit and interest rate risks. Bankers provide advice based on the customer’s particular situation and needs, as those needs change and evolve over the customer’s lifetime and as the market changes.

PYMNTS

DECEMBER 17, 2019

And in considering the appropriate prudential regulatory treatment of crypto assets – which address risk and capital needs – such an endeavor has a “natural starting point” of defining what such assets are – and are not. As the BIS said, “there is no single or generally recognized definition of crypto-assets at present.”. “If

Abrigo

MAY 20, 2022

CAMELS” is an acronym for six different components: Capital Adequacy: The amount of capital that must be held in the financial institution relative to the institution’s asset amount and type of asset risk. Sensitivity to Market Risk: The bank’s position relative to inherent market risks. Lowering Risk.

PYMNTS

JUNE 18, 2019

The capital is going to be utilized by continuing the work of TokenOS , which is one of the leading open banking platforms in the world. Such a fundamental change in the plumbing behind the movement of money creates big challenges for incumbents and large opportunities for new players to create whole new markets.

PYMNTS

MARCH 29, 2016

The European Union is in the midst of several upgrades and overhauls within its financial sector, including ongoing efforts to improve access to working capital for the region’s small and medium-sized businesses. First, EBA declared, continual monitoring of the SME SF and its impact on the market will be key.

CB Insights

AUGUST 3, 2017

We used the conventional definition of Latin America to include all countries in the following regions: South America, Central America, the Caribbean, and Mexico. Note that the market map is illustrative, and not exhaustive of companies in the space. 500 Startups, Kaszek Ventures, Lead Edge Capital. Fiinlab, Vox Capital.

PYMNTS

JANUARY 22, 2018

Expense management technology is now a saturated market, particularly for the small business space – which is notoriously difficult to serve, because they are too small for large, enterprise-grade solutions, but too large for consumer-specialized tools. “Some observers will define the market as $10 million in the top line to $1 billion.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content