Fed, OCC to hold meeting on Capital One-Discover deal

Payments Dive

MAY 15, 2024

Concerns about the $35B merger proposal, which has already faced opposition, are likely to surface again at the July public meeting.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

MAY 15, 2024

Concerns about the $35B merger proposal, which has already faced opposition, are likely to surface again at the July public meeting.

Bank Innovation

JANUARY 29, 2020

With nearly 200 startups, five major banks, 19 venture capital firms and representation from large tech companies like Google, Facebook, PayPal, Toronto is quickly becoming a center for fintech entrepreneurship.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

NOVEMBER 13, 2024

Businesses' working capital cycles are longer. Despite borrowing more and tapping credit lines, they're managing leverage and meeting debt obligations, according to Abrigo's proprietary data. They’re borrowing more, but they’re also managing their leverage and meeting debt obligations —even as they feel the pressure of high rates.

Abrigo

JULY 30, 2020

Key Takeaways Stress tests and capital planning are vital to financial institutions in volatile times like these, when the coronavirus and pressures on the energy sector result in a financial crisis. Current environment = Challenging stressed capital planning. This has resulted in theoretical assumptions for capital planning.

Bank Innovation

MARCH 19, 2020

For insights into these questions, Bank Innovation and INV Fintech, its sister banking innovation services platform, will present a special Zoom meeting on […]. How will banks and startups work together?

PYMNTS

APRIL 10, 2020

After having notched more than $110 million in equity funding in the past, India’s Capital Float has received a top-off of $4.8 Sashank Rishyasringa and Gaurav Hinduja rolled out Capital Float in 2013. Capital Float has provided more than 500,000 clients with $1.2 million from current investors.

PYMNTS

AUGUST 2, 2020

Corsair Capital has agreed to acquire B2B credit and payments provider MSTS , purchasing the company from World Fuel Services Corp. ” In addition, MSTS president Brandon Spear will continue in his leadership role and said in the release that he looks forward to working with Corsair Capital. according to a press release.

PYMNTS

JANUARY 25, 2021

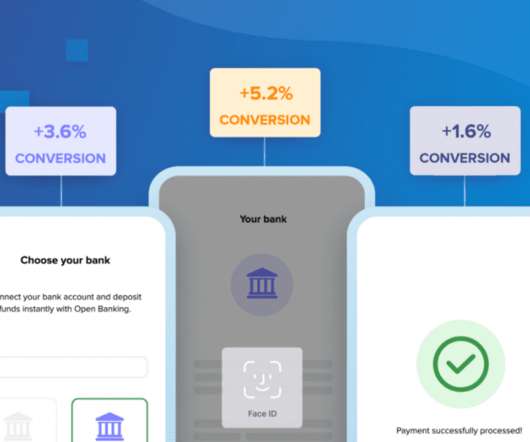

And those three years have given rise to a slew of new companies capitalizing on that initiative all over the world, as well as established companies making their mark. Last week marked the third anniversary of PSD2 , the regulation that launched open banking in the U.K. and Europe.

PYMNTS

SEPTEMBER 7, 2020

Despite the pandemic, venture capital dollars are flowing freely to nascent firms in Asia that are tackling the need for contactless interactions and platforms that match supply and demand — setting the stage for innovation on the other side of the public health crisis.

Perficient

MARCH 22, 2023

Short Capital? SVB Financial had Tier 1 risk-based capital of 15.40% as of December 31, 2022, over 80% higher than the 8.50% regulatory required ratio. Including reserves, the parent company had Total risk-based capital of 16.18%, more than 50% higher than the required ratio of 10.50% for large banks. Tier 1 leverage 8.11

Bank Innovation

NOVEMBER 14, 2017

The finance landscape is witnessing some significant changes and disruptions due to fintech companies, blockchain technology, and AI. Innovation in this highly regulated field is necessary, and even giants are rising to the challenge and trying to get more customer-friendly, agile or at least aligned to the new standards set by start-ups.

PYMNTS

AUGUST 4, 2020

Japanese eCommerce and payments platform hey announced a Series E investment led by Bain Capital , a press release says. The round was also supported by PayPal Ventures , Goldman Sachs, YJ Capital, Anatole, and existing investor World Innovation Group, according to the release.

Perficient

OCTOBER 27, 2022

Current Capital Requirements. of total leverage exposure. *Readers who need assistance with the preparation of their firm’s Living Wills are encouraged to reach out to their local Perficient contact who will be happy to arrange a meeting and quote on the assistance required.*. The current long-term debt calibration for U.S.

Payments Dive

JULY 21, 2024

billion merger at the Friday virtual meeting, a raft of critics urged regulators to block the deal. While some community groups spoke in favor of the $35.3

PYMNTS

DECEMBER 29, 2020

Social distancing and stay-at-home mandates threw normal business operations into disarray and forced CUs to adapt on the fly to meet consumers’ newfound digital preferences and give staff the tools needed for remote operations. Coast Capital has since begun to reconsider its plans for branches as a whole and what they can offer to members.

PYMNTS

JULY 6, 2020

A lot of smart venture capital is betting on open banking to speed up notoriously slow and inefficient B2B payments, easing cashflow shortages and the pressure on suppliers. Laggard No More. Impacts expected from open banking on the laggard B2B payments space are hard to understate.

PYMNTS

NOVEMBER 20, 2020

Fresh on the heels of a $200 million round of fundraising, Tel Aviv’s Red Dot Capital is straying from its bread-and-butter focus on homegrown Israeli technology and security startups to find opportunity half a world away in Southeast Asia.

South State Correspondent

MARCH 4, 2025

Will capital, for instance, become more expensive or cheaper? For example, the problem of improving earnings becomes: Rank the most effective way for the bank to increase profit by 20% within the next 2 years while increasing risk by only 10% and holding capital constant.

PYMNTS

SEPTEMBER 29, 2020

Stripe led the round, and existing investors Y Combinator and Global Founders Capital participated, alongside a new investor, Bedrock Capital. The digital transactions are likely to meet the targets set by the country’s central bank. With the new funding, PayMongo now has a total value of $15 million.

PYMNTS

SEPTEMBER 8, 2020

Wardrobe owns no capital-intensive technology, inventory or real estate, and its customers do its marketing. The company has an unlimited number of lenders/suppliers who are getting use out of the clothes that are taking up room in their physical closets. And it has renters who are encouraged to share their experiences on social media.

PYMNTS

NOVEMBER 16, 2020

While this partnership model remains popular, market volatility has once again created a need to connect more SMBs to capital as quickly and efficiently as possible. In Canada, one of those alternative players is Thinking Capital. This is a market that's going to be digital-first in the future," he said.

PYMNTS

OCTOBER 16, 2020

billion in venture capital investments between January and September 2020, according to a press release from London & Partners emailed to PYMNTS. Global investments are below the levels of pre-pandemic days, but London FinTechs have surpassed their 2018 venture capital totals of $2.3 billion in investments.

PYMNTS

NOVEMBER 24, 2019

GoExpedi , an eCommerce, supply chain and analytics startup, has raised $25 million in Series B funding led by Top Tier Capital Partners. CSL Ventures, Crosslink Capital, Bowery Capital, Blue Bear Capital and other current investors also participated in the round. managing director at Top Tier Capital Partners. “In

PYMNTS

OCTOBER 12, 2020

N26 already has raised nearly $800 million in venture capital, Bloomberg reported, including a $100 million round in May 2020. N26 is among the financial institutions that have benefited from flexibility in meeting customer expectations that is only possible because they are what the industry refers to as “digitally mature” institutions.

Perficient

JULY 7, 2021

The reviews, which can take weeks for small banks and months for large banks, assess an institution’s performance in helping to meet the credit needs of communities, including those of low or moderate-income within its assessment area. Capital One, National Association. Capital One Bank (USA). Examination. Outstanding.

South State Correspondent

APRIL 6, 2020

Like any manufacturing process, banks need to produce a product, in our case loans, to meet the customer’s demand. Loan production takes inputs such as capital, analysis, and documents and combines them in a standardized process to produce an end product. We have often characterized banks as being “manufacturers of credit.”

Perficient

MARCH 17, 2025

Recommended Approach: To capitalize on the rise of embedded finance , financial institutions should focus on several key strategies. Risk + Compliance: Control risk, meet regulations, and stay ahead of financial industry changes.

PYMNTS

JANUARY 26, 2021

Hong Kong’s travel and leisure booking platform Klook has closed a $200 million Series E funding round led by Aspex Management , with participation by Sequoia Capital China , SoftBank Vision Fund, Matrix Partners China and Boyu Capital , according to a press release.

PYMNTS

JULY 17, 2020

Based in Nigeria, B2B eCommerce and supply chain technology startup TradeDepot raised $10 million in a pre-Series B equity round led by Partech, International Finance Corporation, Women Entrepreneurs Finance Initiative and MSA Capital. TechCrunch reported this week that the company raised $10.2 ’s Ravelin secured $20.6

PYMNTS

JANUARY 31, 2021

According to the release, FinTLV’s backers have included Clal insurance, Psagot investment house, Poalim Capital Markets, Ayalon insurance, MS&AD, FWD, Reale Mutua, LB, BDO Israel and Matrix.

PYMNTS

SEPTEMBER 18, 2020

Venture capital appears to be picking back up in the B2B technology startup community. This week saw an impressive $324 million in combined funding for a range of B2B FinTechs and other solution providers, including alternative lenders looking to support small businesses as they manage working capital instability. eFileCabinet.

PYMNTS

SEPTEMBER 30, 2020

“We believe demand by small businesses seeking access to unsecured capital will be at unprecedented levels because most businesses have already accessed the government-backed business loan programs in the U.K. Capify is one of the few online small-business lending platforms in the marketplace that can” meet the needs of SMBs, he noted.

PYMNTS

NOVEMBER 13, 2020

Singapore-based Osome announced $3 million in new funding this week as an extension of its seed round, with XA Network and AltaIR Capital providing the latest investment, TechCrunch reported. Entrée Capital and SBI Investment also participated, alongside other FinTech founders and angel investors.

PYMNTS

SEPTEMBER 22, 2020

IRL , or In Real Life, the social calendar startup created to help users meet over shared experiences, announced a $16 million Series B funding round on Tuesday (Sept. The San Francisco-based company said the infusion of new cash will be used to reinvent its web product and expand the platform overseas. . This new funding will allow us to.

South State Correspondent

JULY 24, 2024

Not everyone needs rewards points, instant payments, or weekend service, but everyone needs cheap capital and more income. They put $40,000, which is the national average for this type of account, on deposit to save for an emergency capital expense, such as if they must replace a forklift or cargo van.

Abrigo

FEBRUARY 25, 2025

But these businessesoften the backbone of their communitiesdepend on access to capital. Applications that dont meet policy can be sent for manual review, then once that is complete, the loan can be put back on the automation path. They often must consult paper files as well as information housed in separate digital systems.

PYMNTS

DECEMBER 29, 2020

We have designed a one-stop solution that is tailored to meet the needs of our customers," CEO and Co-founder Alok Sharma said in the column. Van der Walt said the long-term impact of the virus will come with lower payment volumes and vendors holding back trade capital to help shore up capital.

Perficient

SEPTEMBER 6, 2023

The proposed eligible LTD requirement was calibrated primarily on the basis of what the proposed regulation refers to as a “capital refill” framework. In terms of risk-weighted assets, a covered entity’s common equity Tier 1 Capital level is subject to a minimum requirement of 4.5

PYMNTS

DECEMBER 8, 2020

. Traditional bank account opening methods have long involved visits to branches and face-to-face meetings with officials in which physical identification documents are presented. Capital Float On Using Video-Based KYC To Boost Onboarding, Satisfy Regulators. About The Tracker .

PYMNTS

OCTOBER 20, 2020

With the new partnership and solution, Mphasis customers can access new payments, working capital and Foreign Exchange services, with an aim toward meeting the needs of small and medium-sized businesses (SMBs).

PYMNTS

JUNE 29, 2020

But some analysis suggests supplier payment strategies are in flux to better support the working capital positions of corporates. But according to the firm, some clients may not meet that 90-day deadline. For others, Akamai said it agreed to restructure existing contracts. ” $1.3

Perficient

FEBRUARY 27, 2024

Prioritizing transparency to meet evolving customer expectations and enhance client experiences. By integrating insurance products seamlessly into existing digital ecosystems, insurers can enhance customer engagement and capitalize on emerging business opportunities.

PYMNTS

NOVEMBER 11, 2020

Other investors included Sequoia Capital Global Equities and existing investors Insight Partners and Third Point Ventures, the release stated. The new funding, led by Tiger Global Management, brings SentinelOne’s valuation to over $3 billion.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content