FedNow won’t bring ‘tidal wave’ of change

Payments Dive

APRIL 21, 2023

“Payments solutions reach scale when they provide better usability, affordability, and security,” write partners at a San Francisco venture capital firm.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

APRIL 21, 2023

“Payments solutions reach scale when they provide better usability, affordability, and security,” write partners at a San Francisco venture capital firm.

Bank Innovation

MARCH 9, 2018

EXCLUSIVE - On March 6 in San Francisco, 12 impressive startups demoed their latest in fintech technology at INV Fitnech's 2nd annual demo day. INV Fintech, the sister accelerator to Bank Innovation, is partnered with Fiserv and eight banking partners with over $3 trillion dollars in assets.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

JULY 24, 2020

has secured $80 million in new funding at a $5.5 The latest infusion of cash comes from TSG Consumer Partners , a San Francisco-based private equity company, TechCrunch reported. Revolut is also backed by Index Ventures, the global venture capital firm with dual headquarters in San Francisco and London, and a half dozen others.

PYMNTS

MARCH 1, 2019

Cybersecurity returned to the top of the B2B startup investment list as three companies in the enterprise security realm landed nearly half of the $246 million in B2B venture capital this week. Commerce Ventures, Flint Capital, Two Sigma Ventures, Synchrony and Sorenson Capital also participated, according to reports.

Bank Innovation

MARCH 7, 2018

EXCLUSIVE (SAN FRANCISCO) -- Welcome back to the fintech boom. At this time last year, fintech was in a downturn. Fintech venture funding was down more than 9% year-over-year; valuations seemed stuck. But the fintech market has rebounded.

Bank Innovation

FEBRUARY 18, 2019

Aura, a San Francisco-based fintech offering affordable loans to low to moderate-income households, wants to partner with banks to offer those loans to consumers who have traditionally been unable to secure them from larger institutions.

PYMNTS

JANUARY 30, 2019

Stripe, the San Francisco digital payments startup, has landed a $100 million investment from Tiger Global Management, boosting its valuation above $20 billion. Stripe is a leader in the market, with its platform that enables electronic payments and secure transactions both in-store and online.

PYMNTS

JUNE 29, 2020

“With its tremendous, ongoing success in its core markets, we believe that this merger and its accompanying capital infusion will enable Shift to expand its product offerings and execute on its growth strategies.”. Arison said the move was about adding capital to scale the company. Merging with Insurance Acquisition Corp.

Abrigo

JANUARY 24, 2025

Issuance of commercial mortgage-backed securities (CMBS) rebounded sharply in 2024, with volume jumping 155% year-over-year to more than $100 billion. For example, Trepp data shows that 63% of office loans in San Francisco were categorized as criticized by the second quarter of 2024.

PYMNTS

AUGUST 23, 2020

DoorDash , the San Francisco-based prepared food delivery service, is planning to go public by year’s end, Bloomberg reported, citing sources. In February, the Silicon Valley-based delivery unicorn filed for an initial public offering (IPO) with the Securities and Exchange Commission (SEC). Palantir Technologies Inc.,

PYMNTS

JANUARY 29, 2021

Security and Exchange Commission (SEC) raised concerns, Reuters reported on Friday (Jan. The SEC is investigating how the San Francisco-area startup allocates revenue. . Earlier this month, Roblox raised $520 million in a funding round led by Altimeter Capital and Dragoneer Investment Group. 29), citing an employee memo.

PYMNTS

JUNE 27, 2018

Digital money platform Uphold announced that it has reached an agreement to acquire New York Stock Exchange member JNK Securities Corp. The company has global operations in Braga, London, Los Angeles, Mexico City, and San Francisco. In its 25-year history, JNK has continued to evolve with the financial markets.

PYMNTS

APRIL 28, 2017

venture capital sphere this week: VC funding for FinTech startups in Q1 alone hit $1.2 Analysts said the industry has seen its highest venture capital activity since Q1 of 2016, fueled by focus on late-stage investment rounds. This week’s B2B venture capital roundup is quite indicative of these trends. According to KPMG’s U.S.

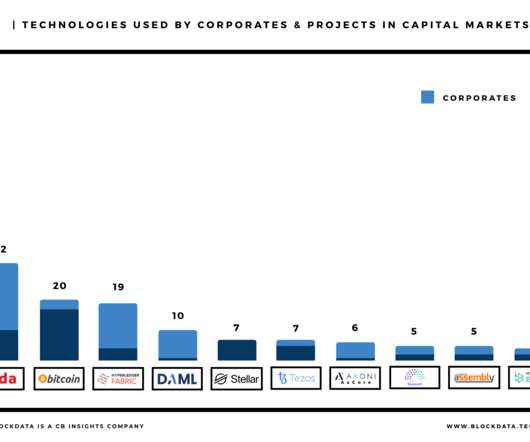

CB Insights

NOVEMBER 19, 2020

As blockchain tech gains commercial traction, a growing number of companies want to use it to reimagine the capital markets infrastructure that powers the trade of stocks, bonds, and other securities. The chart above shows the core blockchain tech being used by projects and corporates working on DLT applications for capital markets.

PYMNTS

SEPTEMBER 17, 2020

We continue to evaluate capital options and are excited about our industry position,” CEO Anthony Hsieh told Bloomberg. Securities and Exchange Commission (SEC). The company has determined not to pursue a public offering of the securities covered by the registration statement at this time,” LoanDepot wrote in its filing.

PYMNTS

DECEMBER 14, 2018

.” In fact, the job grew 33 times faster than other positions this year, with demand highest in San Francisco, New York City and Atlanta. California-based hedge fund Pantera Capital has revealed that it might have to issue refunds to its backers after the U.S.

PYMNTS

DECEMBER 5, 2016

Public transport riders in San Francisco got something of an early Christmas present last week – courtesy of a cybercriminal getting some coal in his stocking. San Francisco’s Muni public transit system was reportedly hit by a ransomware attack last weekend (Nov. Hack A Municipal Transit System — Get Hacked Back.

PYMNTS

NOVEMBER 26, 2019

The New York Stock Exchange (NYSE) wants to amend rules so that companies can go public through a direct listing, and raise capital from public market investors at the same time. As it stands now, companies cannot raise capital with a direct listing. Both companies were able to do this due to sufficient capital on their balance sheets.

PYMNTS

MAY 25, 2016

San Francisco-based wealth management technology company SigFig announced on Tuesday (May 24) that it raised a $40 million funding round from a slew of VCs and financial institutions. The firm said its new capital will be used to accelerate the expansion of its team and robo-advisor technology platform.

PYMNTS

JULY 7, 2020

Securities and Exchange Commission (SEC) on Tuesday (July 7), the stock is expected to be priced between $22.00 Founded in 2012, nCino has raised $213 million in venture-backed funding, according to Crunchbase, the San Francisco provider of business data about private and public companies. million shares of its stock.

PYMNTS

NOVEMBER 3, 2017

It was a busy time for B2B venture capital this week, and while funding ranged across verticals from expense management to SaaS, there was a clear theme in investment rounds: high-tech data analytics. Intel Capital, California Technology Ventures, Tesi, SmartFin Capital and Open Ocean also participated in the round.

PYMNTS

AUGUST 23, 2020

Once the approval is finalized, the license will allow it to work in dealing in securities and as an automated trading service (ATS), regulated under Hong Kong's Securities and Futures Commission (SFC). SEC filings show that the fund has a total of $300 million in assets overall now.

PYMNTS

SEPTEMBER 19, 2019

The investment was led by GPI Capital, and it brings the company’s total funding amount to date to almost $1 billion. Postmates got JPMorgan Chase and Bank of America to help with IPO preparation, and it filed privately with the Securities and Exchange Commission earlier in the year. and after 6:30 p.m. on weekdays.

PYMNTS

FEBRUARY 17, 2017

In hyper-competitive markets like Boston, New York and San Francisco, many buyers overbid and sometimes wave inspections to sweeten the pot for sellers. While this may seem like a great tactic for securing a home in a great location, inspections provide useful information that gives buyers leverage on price negotiations.

PYMNTS

APRIL 21, 2020

The opening of a Hong Kong outpost is part of SoFi’s bid to acquire online brokerage firm 8 Securities, while expanding its business and serving up commission-free trading there. SoFi, which deals with consumer financial services, said it will continue to serve existing 8 Securities brokerage customers. billion.

PYMNTS

SEPTEMBER 2, 2019

Venture capital firm Andreessen Horowitz is attempting to fight back against Washington’s tougher stance on cryptocurrencies. And as Bart Stephens, co-founder and managing partner of Blockchain Capital, a venture capital investor focused on cryptocurrencies, noted, “The U.S.

PYMNTS

MARCH 5, 2019

Munchery had said it was planning to focus on its largest market, San Francisco, in an effort to become profitable, but that never happened. million in senior secured debt, as well as convertible debt of approximately $23 million. That came after it shut down service in Seattle, Los Angels, and New York.

PYMNTS

APRIL 30, 2020

The FinTech company, based in both San Francisco and Nigeria, secured the venture capital (VC) investment from Worldpay , which has also struck a strategic partnership with the firm. At the time, Flutterwave said it would use the funding to further build out its technology and continue expanding throughout Africa.

PYMNTS

JANUARY 26, 2018

Three big Silicon Valley venture capital firms want to invest in Telegram ’s initial coin offering (ICO), The Financial Times reported. Kleiner Perkins Caufield & Byers, Benchmark and Sequoia Capital have each told the messaging startup that they want to invest $20 million, according to three individuals familiar with the deal.

Abrigo

DECEMBER 18, 2023

WATCH Takeaway 1 Banks and credit unions are critical sources of capital for businesses in their communities, so how institutions assess CRE credits matters. Takeaway 3 Loan-level stress testing can help assess repricing risk, while capital stress testing helps clarify the impact of CRE loan losses on capital.

PYMNTS

SEPTEMBER 28, 2020

He said the company’s new owners include PIMCO, a California-based global investment management firm, Davidson Kempner Capital Management LP, a global institutional alternative investment management firm headquartered in New York City and Sixth Street Partners, the San Francisco global investment firm.

PYMNTS

OCTOBER 5, 2020

The transaction will create a company with a combined market capitalization of around 15 billion euros ($17.6 billion) to acquire Ingenico Group , the Paris-based technology provider of secure electronic transactions to create a FinTech dynamo. the San Francisco-based financial services company. billion euros ($5.4

PYMNTS

OCTOBER 10, 2018

Homeownership startup Divvy announced that it has raised $30 million in equity and debt from Andreessen Horowitz , with participation from seed investors Caffeinated Capital, DFJ and PayPal Co-founder Max Levchin. “We get the privilege of buying homes for deserving families every day, and it’s a responsibility we don’t take lightly.

PYMNTS

SEPTEMBER 20, 2016

It’s the next step in San Francisco-based Stripe making strides into other countries. The business is backed by Sequoia Capital and PayPal founders Peter Thiel and Elon Musk. Payment startup Stripe is heading to Singapore with the mission to help other local startups kickstart online businesses.

PYMNTS

APRIL 8, 2019

“Our mission is to help these people build financial security and help them remain committed to their communities,” Landed co-founder Alex Lofton said. “We Landed said it has helped 200 teachers so far in areas like San Francisco Bay, Seattle and Denver. We try to stay flexible to people’s realities.

PYMNTS

FEBRUARY 24, 2016

23) $30 million in venture capital raised from Sequoia Capital and other backers, including Matrix Partners, True Ventures and Greenspring Associates. According to reports, Namely secured the backing following last June’s Series C funding round, meaning the firm has now raised a total of $107.8

PYMNTS

APRIL 2, 2018

Citing Securities and Exchange Commission documents, Cheddar reported it raised the $850 million in February, in what was its second round of fundraising. A San Francisco cryptocurrency investor told the paper that the company’s plans were “hyperbolic claims” and a “huge red flag.” That would bring the total to $2.5

PYMNTS

FEBRUARY 19, 2019

Account takeovers are becoming bigger business for criminals — or, at least, the business of preventing account takeovers in the digital retail and payments realm is becoming an increasing focus of companies and security experts. The new capital will help fuel hiring and other growth, the company said. Account Takeover Growth.

PYMNTS

SEPTEMBER 10, 2019

San Francisco-based Payments startup Stripe is rolling out its services in eight new European countries, the company said in a press release on Monday (Sept. Stripe taps into machine learning for enhanced security safeguards to help prevent fraudulent transactions. . The company also announced Thursday (Sept.

PYMNTS

DECEMBER 20, 2017

million in new venture capital (VC) funding. 18) reports from TechCrunch said AxleHire — which facilitates last-mile logistics and delivery for subscription commerce and consumer packaged goods (CPG) firms like HelloFresh and La Boulangerie — has secured the new funding from contributors like Acorn Pacific, RGA Ventures and other backers.

BankInovation

AUGUST 19, 2022

Fintech Arc announced Wednesday that it has secured $20 million in a series A funding round. The San Francisco-based startup’s platform gives software-as-a-service startups access to upfront capital and provides a cash management account to store and spend funds.

Insights on Business

NOVEMBER 8, 2018

Rob Palacios, EVP and Director of TCB Labs at Texas Capital Bank, sat down with Yousef Hashimi from IBM at Money2020 to discuss the banks’ work around AI and their use of the IBM Garage. You can learn more about Fraud Prevention capabilities at upcoming events in San Francisco (Nov 27) and New York City (Nov 28). .

PYMNTS

JULY 21, 2017

million in a venture capital funding round to compete with Amazon in the eCommerce fashion business. million venture capital funding round in the company, and part of the VC money was secured on Apple’s “Planet of the Apps” startup show. A newly launched retail app called Dote has raised $7.2

PYMNTS

MAY 23, 2019

attorney’s office in San Francisco, according to the transcript from a civil Securities & Exchange Commission (SEC) case obtained by CNBC. And the Central District Court in Israel has ruled that bitcoin is an asset and subject to capital gains tax (CGT). The criminal case is being handled by the U.S. million).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content