Top Banks Looking To Washington For Growth, Clarity

PYMNTS

JULY 21, 2017

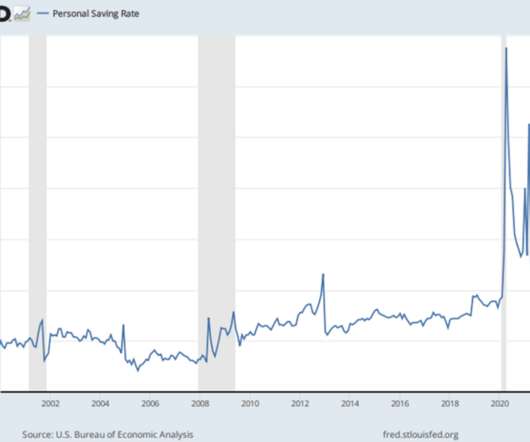

.’s largest banks are looking to Washington, D.C., According to Morgan Stanley CEO James Gorman, lower corporate taxes and more streamlined bank regulation could “allow U.S. But while many bank CEOs have fixed their eyes on Washington to promote industry growth, not every executive is optimistic.

Let's personalize your content