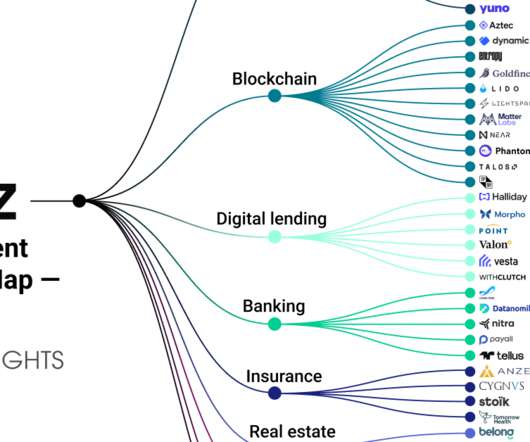

Why fintechs—and Snoop Dogg—are in the $160 billion installment lending market

Payments Source

FEBRUARY 19, 2020

When established card networks such as Visa, American Express and Mastercard start investing in fintech lending platforms such as Divido and ChargeAfter — as well as in the fintech lenders themselves such as Klarna and Vyze — it’s a clear signal that the future of unsecured personal loans may not be delivered by banks.

Let's personalize your content