Millennial credit card delinquencies rise: New York Fed

Payments Dive

NOVEMBER 8, 2023

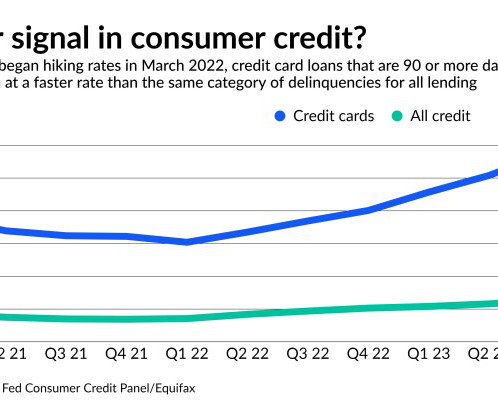

Nearly 3% of millennials are newly delinquent as of the third quarter this year, slightly up from 2.5% in Q3 2019, according to a report from the Federal Reserve Bank of New York.

Let's personalize your content